Stock Analysis

- India

- /

- Specialty Stores

- /

- NSEI:ABFRL

Reflecting on Aditya Birla Fashion and Retail's (NSE:ABFRL) Share Price Returns Over The Last Year

While not a mind-blowing move, it is good to see that the Aditya Birla Fashion and Retail Limited (NSE:ABFRL) share price has gained 21% in the last three months. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 31% in the last year, well below the market return.

See our latest analysis for Aditya Birla Fashion and Retail

Aditya Birla Fashion and Retail isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Aditya Birla Fashion and Retail's revenue didn't grow at all in the last year. In fact, it fell 33%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 31% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

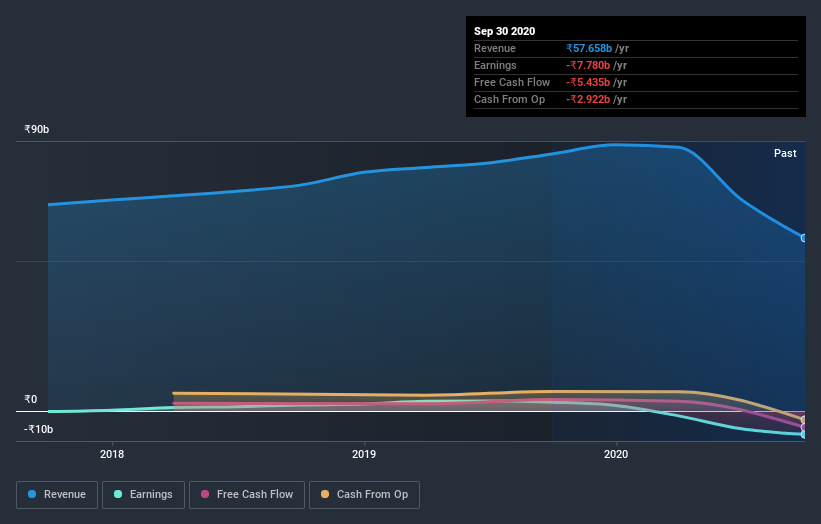

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 17% in the last year, Aditya Birla Fashion and Retail shareholders lost 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Aditya Birla Fashion and Retail (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

But note: Aditya Birla Fashion and Retail may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Aditya Birla Fashion and Retail, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Aditya Birla Fashion and Retail is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ABFRL

Aditya Birla Fashion and Retail

Designs, manufactures, distributes, and retails fashion apparel and accessories in India and internationally.

Reasonable growth potential with adequate balance sheet.