- India

- /

- Professional Services

- /

- NSEI:VINSYS

Is Vinsys IT Services India (NSE:VINSYS) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Vinsys IT Services India Limited (NSE:VINSYS) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Vinsys IT Services India

What Is Vinsys IT Services India's Net Debt?

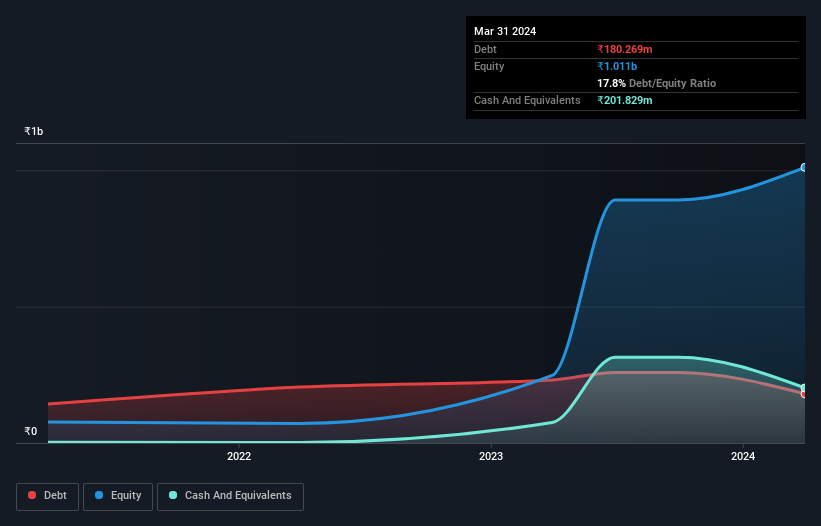

You can click the graphic below for the historical numbers, but it shows that Vinsys IT Services India had ₹180.3m of debt in March 2024, down from ₹231.1m, one year before. But on the other hand it also has ₹201.8m in cash, leading to a ₹21.6m net cash position.

How Healthy Is Vinsys IT Services India's Balance Sheet?

We can see from the most recent balance sheet that Vinsys IT Services India had liabilities of ₹205.7m falling due within a year, and liabilities of ₹163.2m due beyond that. On the other hand, it had cash of ₹201.8m and ₹434.7m worth of receivables due within a year. So it can boast ₹267.6m more liquid assets than total liabilities.

This surplus suggests that Vinsys IT Services India has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Vinsys IT Services India boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Vinsys IT Services India has boosted its EBIT by 39%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is Vinsys IT Services India's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Vinsys IT Services India may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Vinsys IT Services India burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case Vinsys IT Services India has ₹21.6m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 39% over the last year. So we don't have any problem with Vinsys IT Services India's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Vinsys IT Services India (including 1 which doesn't sit too well with us) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VINSYS

Vinsys IT Services India

Engages in IT service and manpower supply business in India and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success