- India

- /

- Professional Services

- /

- NSEI:REPL

What Is Rudrabhishek Enterprises's (NSE:REPL) P/E Ratio After Its Share Price Rocketed?

Rudrabhishek Enterprises (NSE:REPL) shareholders are no doubt pleased to see that the share price has had a great month, posting a 32% gain, recovering from prior weakness. But shareholders may not all be feeling jubilant, since the share price is still down 25% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for Rudrabhishek Enterprises

How Does Rudrabhishek Enterprises's P/E Ratio Compare To Its Peers?

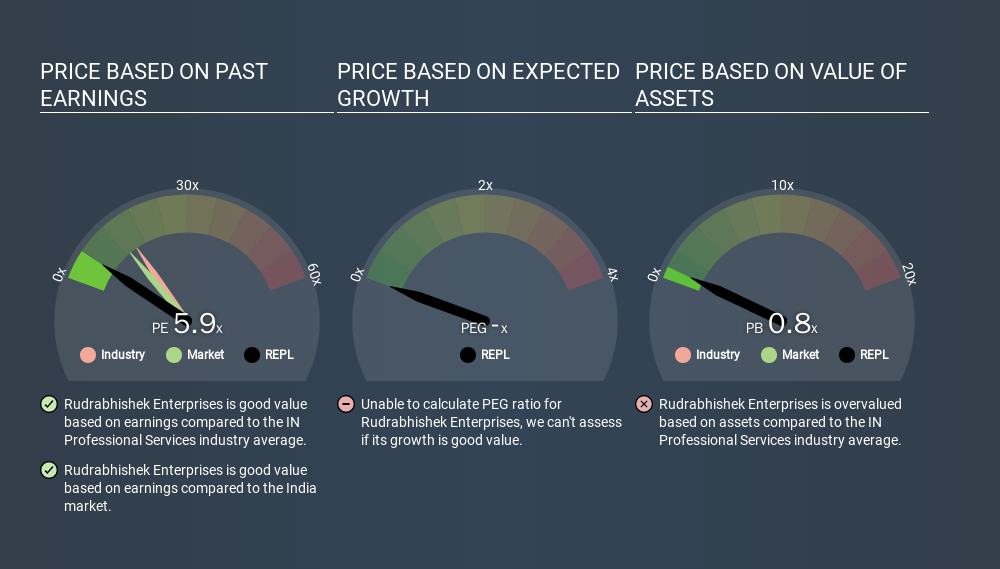

Rudrabhishek Enterprises's P/E of 5.87 indicates relatively low sentiment towards the stock. We can see in the image below that the average P/E (15.2) for companies in the professional services industry is higher than Rudrabhishek Enterprises's P/E.

This suggests that market participants think Rudrabhishek Enterprises will underperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. That means even if the current P/E is low, it will increase over time if the share price stays flat. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

It's great to see that Rudrabhishek Enterprises grew EPS by 23% in the last year. And it has bolstered its earnings per share by 2.7% per year over the last five years. This could arguably justify a relatively high P/E ratio. Unfortunately, earnings per share are down 5.5% a year, over 3 years. So if Rudrabhishek Enterprises grows EPS going forward, that should be a positive for the share price. I would further inform my view by checking insider buying and selling., among other things.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Rudrabhishek Enterprises's Balance Sheet

Rudrabhishek Enterprises has net cash of ₹60m. This is fairly high at 12% of its market capitalization. That might mean balance sheet strength is important to the business, but should also help push the P/E a bit higher than it would otherwise be.

The Bottom Line On Rudrabhishek Enterprises's P/E Ratio

Rudrabhishek Enterprises's P/E is 5.9 which is below average (12.9) in the IN market. The net cash position gives plenty of options to the business, and the recent improvement in EPS is good to see. The relatively low P/E ratio implies the market is pessimistic. What is very clear is that the market has become less pessimistic about Rudrabhishek Enterprises over the last month, with the P/E ratio rising from 4.4 back then to 5.9 today. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

But note: Rudrabhishek Enterprises may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:REPL

Rudrabhishek Enterprises

Operates as an urban development and infrastructure consultant in India.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion