- India

- /

- Professional Services

- /

- NSEI:BLSE

Why Investors Shouldn't Be Surprised By BLS E-Services Limited's (NSE:BLSE) 39% Share Price Surge

BLS E-Services Limited (NSE:BLSE) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

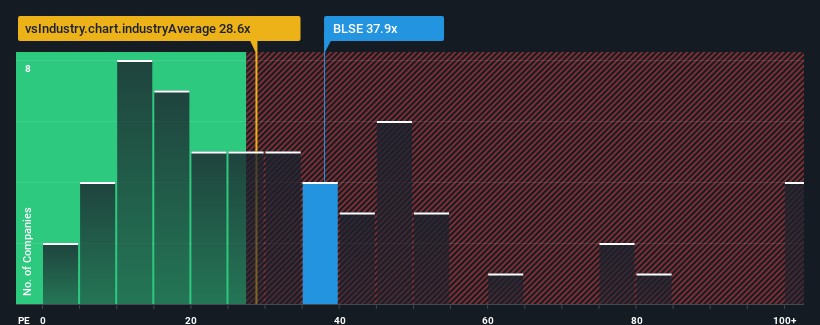

Since its price has surged higher, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 27x, you may consider BLS E-Services as a stock to potentially avoid with its 37.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

We've discovered 1 warning sign about BLS E-Services. View them for free.For instance, BLS E-Services' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for BLS E-Services

How Is BLS E-Services' Growth Trending?

In order to justify its P/E ratio, BLS E-Services would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Even so, admirably EPS has lifted 511% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that BLS E-Services' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From BLS E-Services' P/E?

The large bounce in BLS E-Services' shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of BLS E-Services revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for BLS E-Services that we have uncovered.

Of course, you might also be able to find a better stock than BLS E-Services. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BLS E-Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLSE

BLS E-Services

A technology enabled digital service company, provides assisted E-services and E-governance services in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives