Optimistic Investors Push V.S.T. Tillers Tractors Limited (NSE:VSTTILLERS) Shares Up 29% But Growth Is Lacking

The V.S.T. Tillers Tractors Limited (NSE:VSTTILLERS) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

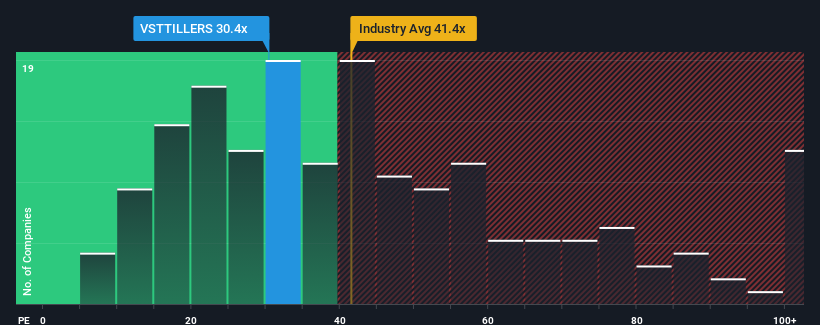

Even after such a large jump in price, you could still be forgiven for feeling indifferent about V.S.T. Tillers Tractors' P/E ratio of 30.4x, since the median price-to-earnings (or "P/E") ratio in India is also close to 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, V.S.T. Tillers Tractors has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for V.S.T. Tillers Tractors

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like V.S.T. Tillers Tractors' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. The latest three year period has also seen an excellent 33% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 2.9% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to expand by 25%, which is noticeably more attractive.

With this information, we find it interesting that V.S.T. Tillers Tractors is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From V.S.T. Tillers Tractors' P/E?

V.S.T. Tillers Tractors' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of V.S.T. Tillers Tractors' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for V.S.T. Tillers Tractors you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VSTTILLERS

V.S.T. Tillers Tractors

Manufactures and trades agriculture machinery in India and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives