Investing in Timken India (NSE:TIMKEN) five years ago would have delivered you a 480% gain

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Timken India Limited (NSE:TIMKEN) share price. It's 450% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. Then again, the 9.9% share price decline hasn't been so fun for shareholders. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Timken India

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

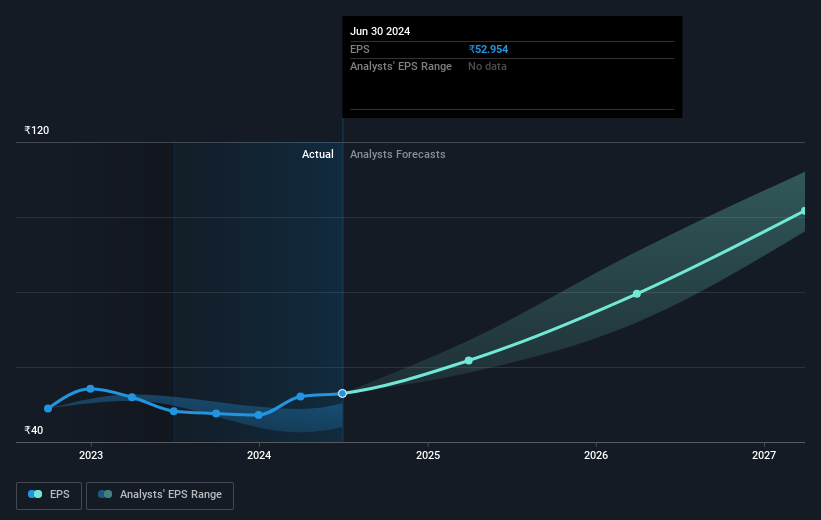

During five years of share price growth, Timken India achieved compound earnings per share (EPS) growth of 19% per year. This EPS growth is slower than the share price growth of 41% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 72.66.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Timken India's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Timken India, it has a TSR of 480% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Timken India shareholders gained a total return of 20% during the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 42% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before deciding if you like the current share price, check how Timken India scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Timken India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIMKEN

Timken India

Manufactures and distributes tapered roller bearings, other roller bearings, components, and accessories for the automotive sector and railway industry in India, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.