Here's Why We Think Texmaco Rail & Engineering (NSE:TEXRAIL) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Texmaco Rail & Engineering (NSE:TEXRAIL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Texmaco Rail & Engineering

How Fast Is Texmaco Rail & Engineering Growing Its Earnings Per Share?

In the last three years Texmaco Rail & Engineering's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Texmaco Rail & Engineering's EPS shot from ₹2.62 to ₹6.38, over the last year. It's not often a company can achieve year-on-year growth of 144%. That could be a sign that the business has reached a true inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Texmaco Rail & Engineering is growing revenues, and EBIT margins improved by 2.3 percentage points to 8.4%, over the last year. Both of which are great metrics to check off for potential growth.

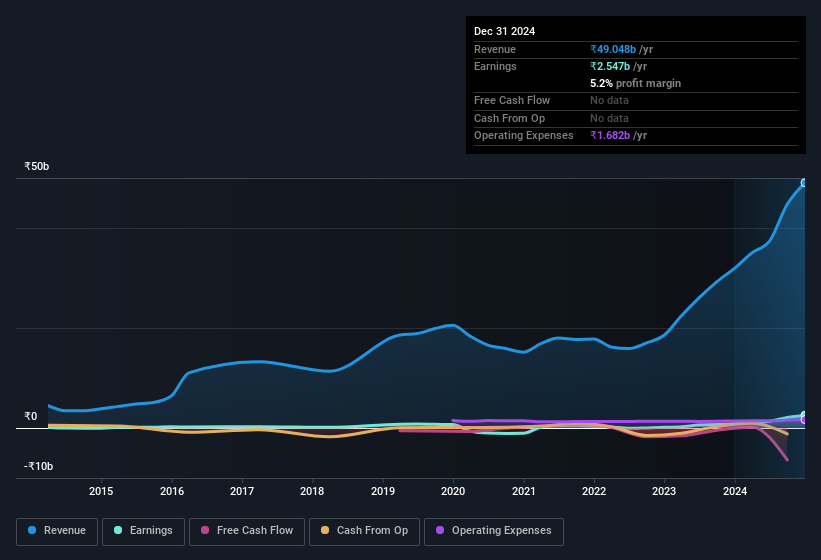

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Texmaco Rail & Engineering.

Are Texmaco Rail & Engineering Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Texmaco Rail & Engineering followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at ₹3.7b. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 7.3% of the shares on issue for the business, an appreciable amount considering the market cap.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Texmaco Rail & Engineering, with market caps between ₹17b and ₹70b, is around ₹27m.

Texmaco Rail & Engineering's CEO took home a total compensation package of ₹13m in the year prior to March 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Texmaco Rail & Engineering To Your Watchlist?

Texmaco Rail & Engineering's earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Texmaco Rail & Engineering certainly ticks a few boxes, so we think it's probably well worth further consideration. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Texmaco Rail & Engineering that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives