Results: Tega Industries Limited Beat Earnings Expectations And Analysts Now Have New Forecasts

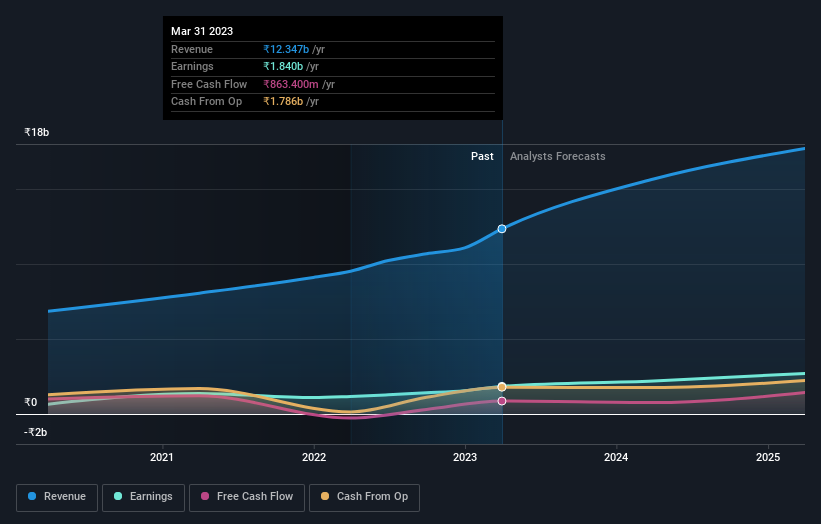

Tega Industries Limited (NSE:TEGA) just released its latest full-year results and things are looking bullish. Tega Industries beat earnings, with revenues hitting ₹12b, ahead of expectations, and statutory earnings per share outperforming analyst reckonings by a solid 12%. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimate to see what could be in store for next year.

Check out our latest analysis for Tega Industries

Following the latest results, Tega Industries' one analyst are now forecasting revenues of ₹15.7b in 2024. This would be a huge 27% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to grow 19% to ₹33.10. In the lead-up to this report, the analyst had been modelling revenues of ₹13.0b and earnings per share (EPS) of ₹29.01 in 2024. So we can see there's been a pretty clear increase in sentiment following the latest results, with both revenues and earnings per share receiving a decent lift in the latest estimates.

With these upgrades, we're not surprised to see that the analyst has lifted their price target 20% to ₹900per share.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Tega Industries' rate of growth is expected to accelerate meaningfully, with the forecast 27% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 18% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Tega Industries to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Tega Industries' earnings potential next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

With that in mind, we wouldn't be too quick to come to a conclusion on Tega Industries. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Tega Industries going out as far as 2025, and you can see them free on our platform here.

You can also view our analysis of Tega Industries' balance sheet, and whether we think Tega Industries is carrying too much debt, for free on our platform here.

Valuation is complex, but we're here to simplify it.

Discover if Tega Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEGA

Tega Industries

Designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives