- India

- /

- Construction

- /

- NSEI:SWSOLAR

After Leaping 27% Sterling and Wilson Renewable Energy Limited (NSE:SWSOLAR) Shares Are Not Flying Under The Radar

Sterling and Wilson Renewable Energy Limited (NSE:SWSOLAR) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last month tops off a massive increase of 126% in the last year.

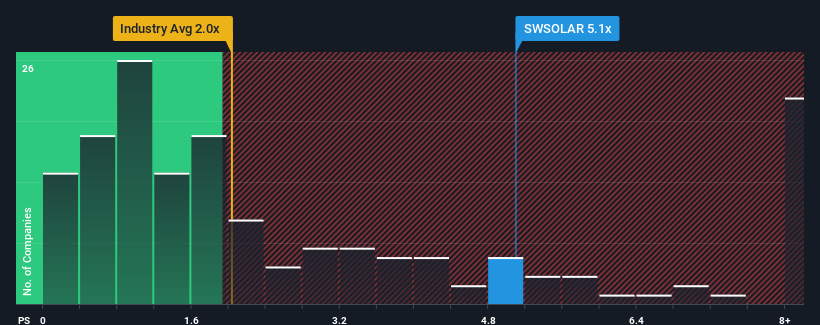

After such a large jump in price, when almost half of the companies in India's Construction industry have price-to-sales ratios (or "P/S") below 2x, you may consider Sterling and Wilson Renewable Energy as a stock not worth researching with its 5.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sterling and Wilson Renewable Energy

How Has Sterling and Wilson Renewable Energy Performed Recently?

Sterling and Wilson Renewable Energy certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Sterling and Wilson Renewable Energy will help you uncover what's on the horizon.How Is Sterling and Wilson Renewable Energy's Revenue Growth Trending?

In order to justify its P/S ratio, Sterling and Wilson Renewable Energy would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 51% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 40% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 195% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Sterling and Wilson Renewable Energy's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Sterling and Wilson Renewable Energy's P/S?

The strong share price surge has lead to Sterling and Wilson Renewable Energy's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Sterling and Wilson Renewable Energy's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sterling and Wilson Renewable Energy you should know about.

If these risks are making you reconsider your opinion on Sterling and Wilson Renewable Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SWSOLAR

Sterling and Wilson Renewable Energy

Provides renewable engineering, procurement, and construction (EPC) services in India, Europe, the Middle East, North Africa, rest of Africa, the United States, Latin America, and Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success