- India

- /

- Electrical

- /

- NSEI:SWELECTES

Swelect Energy Systems Limited's (NSE:SWELECTES) 26% Jump Shows Its Popularity With Investors

Swelect Energy Systems Limited (NSE:SWELECTES) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 122% in the last year.

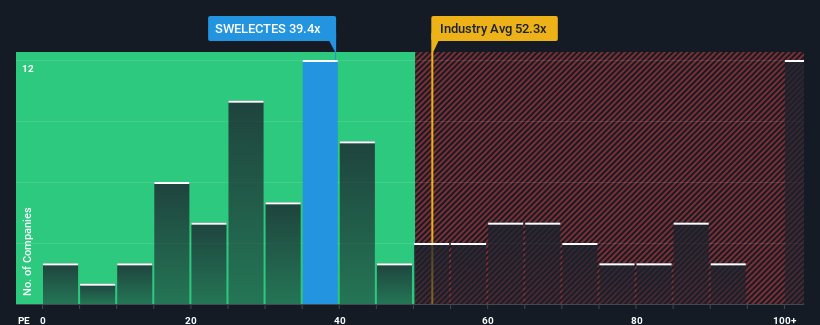

Following the firm bounce in price, Swelect Energy Systems' price-to-earnings (or "P/E") ratio of 39.4x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 34x and even P/E's below 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been quite advantageous for Swelect Energy Systems as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Swelect Energy Systems

How Is Swelect Energy Systems' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Swelect Energy Systems' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 58% gain to the company's bottom line. The latest three year period has also seen an excellent 349% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Swelect Energy Systems' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Swelect Energy Systems' P/E

Swelect Energy Systems shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Swelect Energy Systems maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Swelect Energy Systems (2 are concerning) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SWELECTES

Swelect Energy Systems

Engages in the manufacture and trading of solar modules, mounting structures, transformers, and inverters in India, Europe, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives