- India

- /

- Electrical

- /

- NSEI:SWELECTES

Market Participants Recognise Swelect Energy Systems Limited's (NSE:SWELECTES) Earnings Pushing Shares 38% Higher

Swelect Energy Systems Limited (NSE:SWELECTES) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last month tops off a massive increase of 119% in the last year.

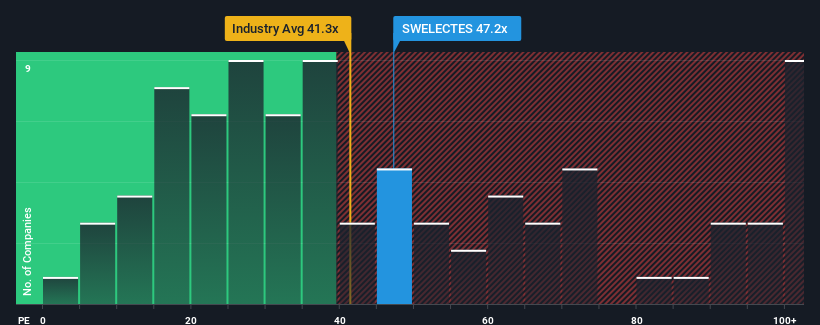

Following the firm bounce in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Swelect Energy Systems as a stock to avoid entirely with its 47.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Swelect Energy Systems' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Swelect Energy Systems

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Swelect Energy Systems' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 54%. Still, the latest three year period has seen an excellent 164% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Swelect Energy Systems is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Swelect Energy Systems' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Swelect Energy Systems maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Swelect Energy Systems (1 is potentially serious) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SWELECTES

Swelect Energy Systems

Engages in the manufacture and trading of solar modules, mounting structures, transformers, and inverters in India, Europe, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives