As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching sector-specific impacts, with financials and energy gaining traction while healthcare faces challenges. Amidst these fluctuations, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance risk in a dynamic economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.74% | ★★★★★☆ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

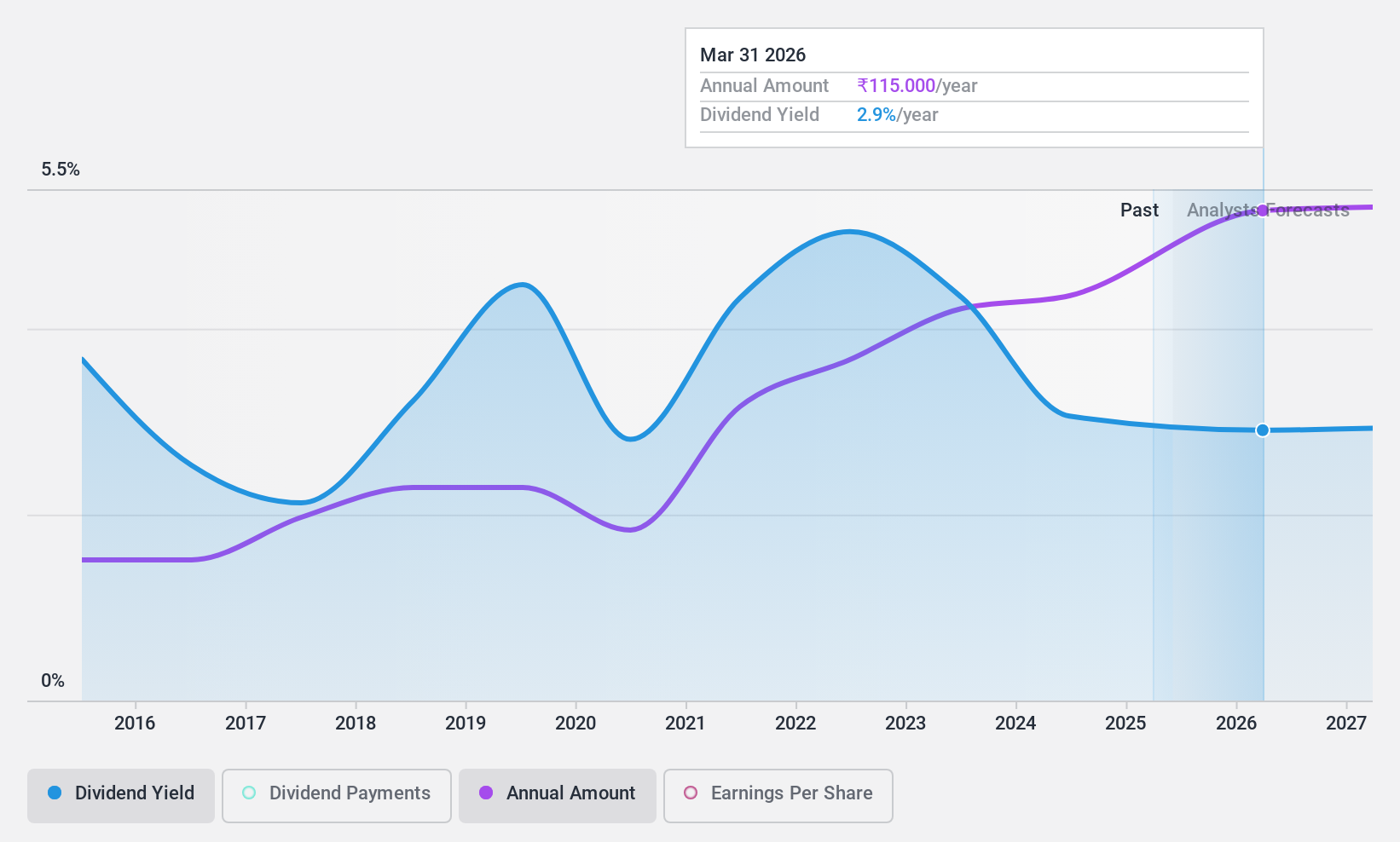

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited manufactures and sells diesel engines, components, and spare parts for tractors in India, with a market cap of ₹35.48 billion.

Operations: Swaraj Engines Limited generates revenue of ₹15.13 billion from its diesel engines, components, and spare parts for tractors.

Dividend Yield: 3.3%

Swaraj Engines' dividend yield of 3.25% ranks in the top 25% among Indian dividend payers, though its sustainability is questionable due to a high cash payout ratio of 107.3%. While earnings have grown consistently at 15.5% annually over five years, dividends have been volatile and not reliably covered by free cash flows. Recent earnings growth and a price-to-earnings ratio below the market average suggest value potential, but dividend reliability remains a concern.

- Take a closer look at Swaraj Engines' potential here in our dividend report.

- Our valuation report unveils the possibility Swaraj Engines' shares may be trading at a discount.

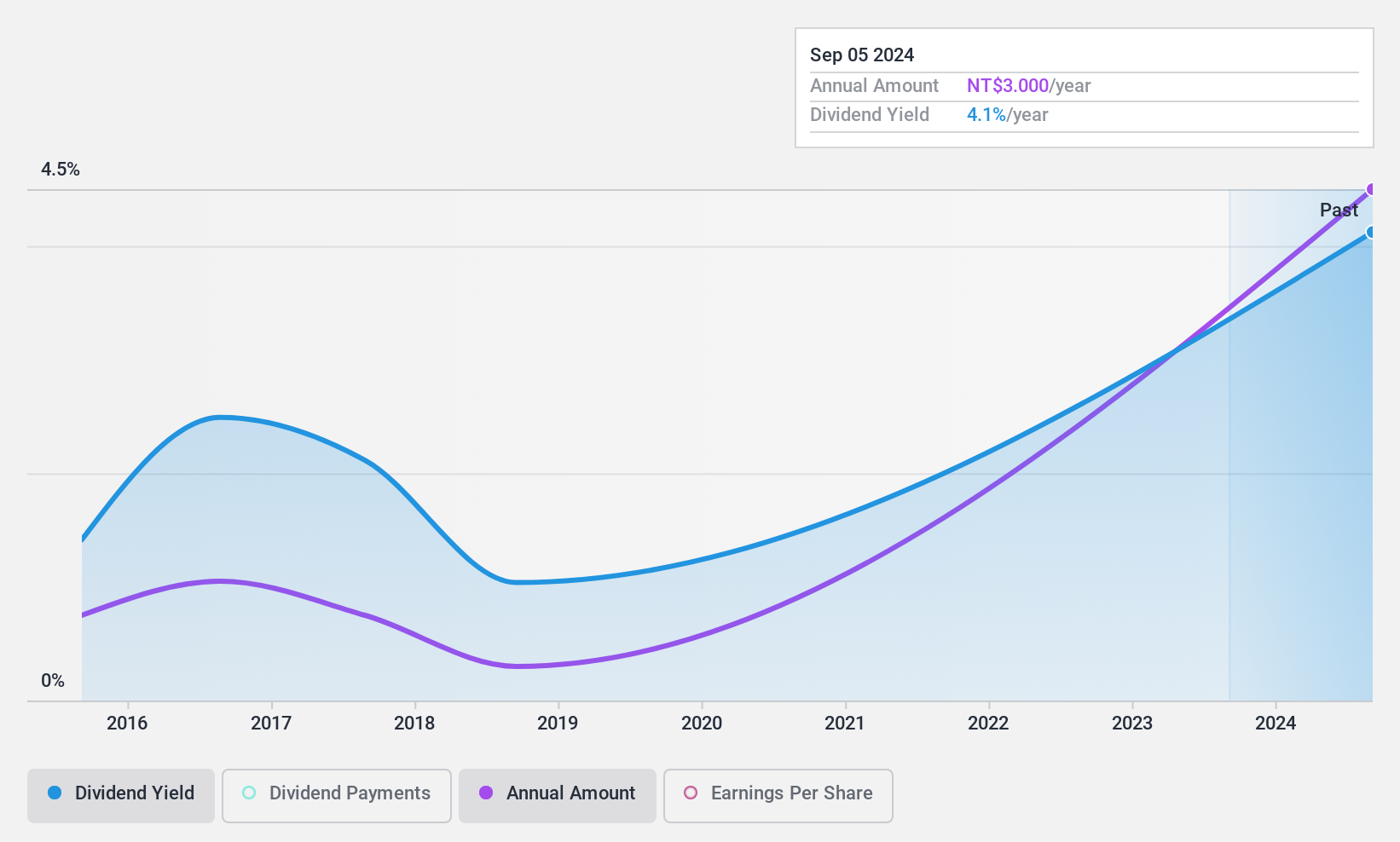

Allmind Holdings (TPEX:2718)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Allmind Holdings Corporation is involved in the development and rental of houses and buildings in Taiwan, with a market capitalization of NT$8.07 billion.

Operations: Allmind Holdings Corporation generates revenue primarily from its real estate development and rental activities in Taiwan.

Dividend Yield: 3.3%

Allmind Holdings' dividend payments are well-covered by earnings and cash flows, with low payout ratios of 8.6% and 7%, respectively. However, the dividend yield of 3.25% is below the top tier in Taiwan, and its track record has been volatile over the past decade despite recent growth. The company's significant earnings increase—net income rising to TWD 2.91 billion for Q3—highlights strong financial performance but does not assure stable dividends going forward.

- Unlock comprehensive insights into our analysis of Allmind Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Allmind Holdings shares in the market.

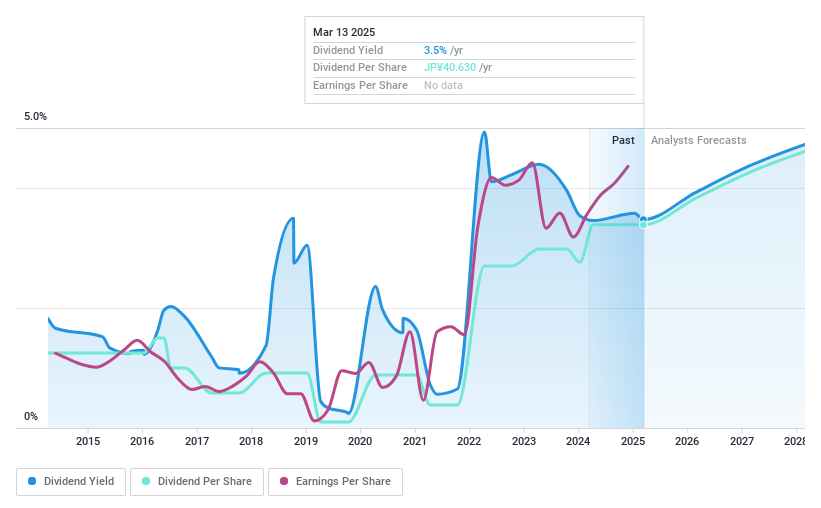

IDOM (TSE:7599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDOM Inc. engages in the purchase and sale of used cars both in Japan and internationally, with a market capitalization of approximately ¥106.33 billion.

Operations: IDOM Inc.'s revenue is primarily derived from its operations in purchasing and selling used cars across domestic and international markets.

Dividend Yield: 3.8%

IDOM's dividend yield of 3.84% ranks in the top 25% in Japan, yet its payments are not covered by free cash flows and have been unreliable over the past decade. Despite a low payout ratio of 41%, recent earnings growth and undervaluation relative to fair value suggest potential, but high volatility and non-cash earnings raise concerns about sustainability. The company's debt is not well-covered by operating cash flow, impacting financial stability for consistent dividends.

- Dive into the specifics of IDOM here with our thorough dividend report.

- According our valuation report, there's an indication that IDOM's share price might be on the cheaper side.

Key Takeaways

- Get an in-depth perspective on all 1970 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SWARAJENG

Swaraj Engines

Manufactures and sells diesel engines and its engine components, hi-tech engine, and spare parts for tractors in India.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives