Following a rise of over 1 per cent, which ended a three-day losing streak, the Indian stock market benchmark Nifty 50 experienced a nearly 1 per cent drop during intraday trading on Thursday, August 8. The market trend reflects buying on dips and profit booking at higher levels, driven by heightened geopolitical tensions and concerns over US economic growth. In such volatile conditions, dividend stocks can offer a stable income stream and potentially cushion against market fluctuations.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| D. B (NSEI:DBCORP) | 5.05% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.34% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.63% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.22% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.21% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.29% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.26% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.01% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.15% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.72% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Indian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited manufactures and sells diesel engines, components, and spare parts for tractors in India, with a market cap of ₹36.37 billion.

Operations: Swaraj Engines Limited generates ₹14.37 billion in revenue from its diesel engines, components, and spare parts for tractors in India.

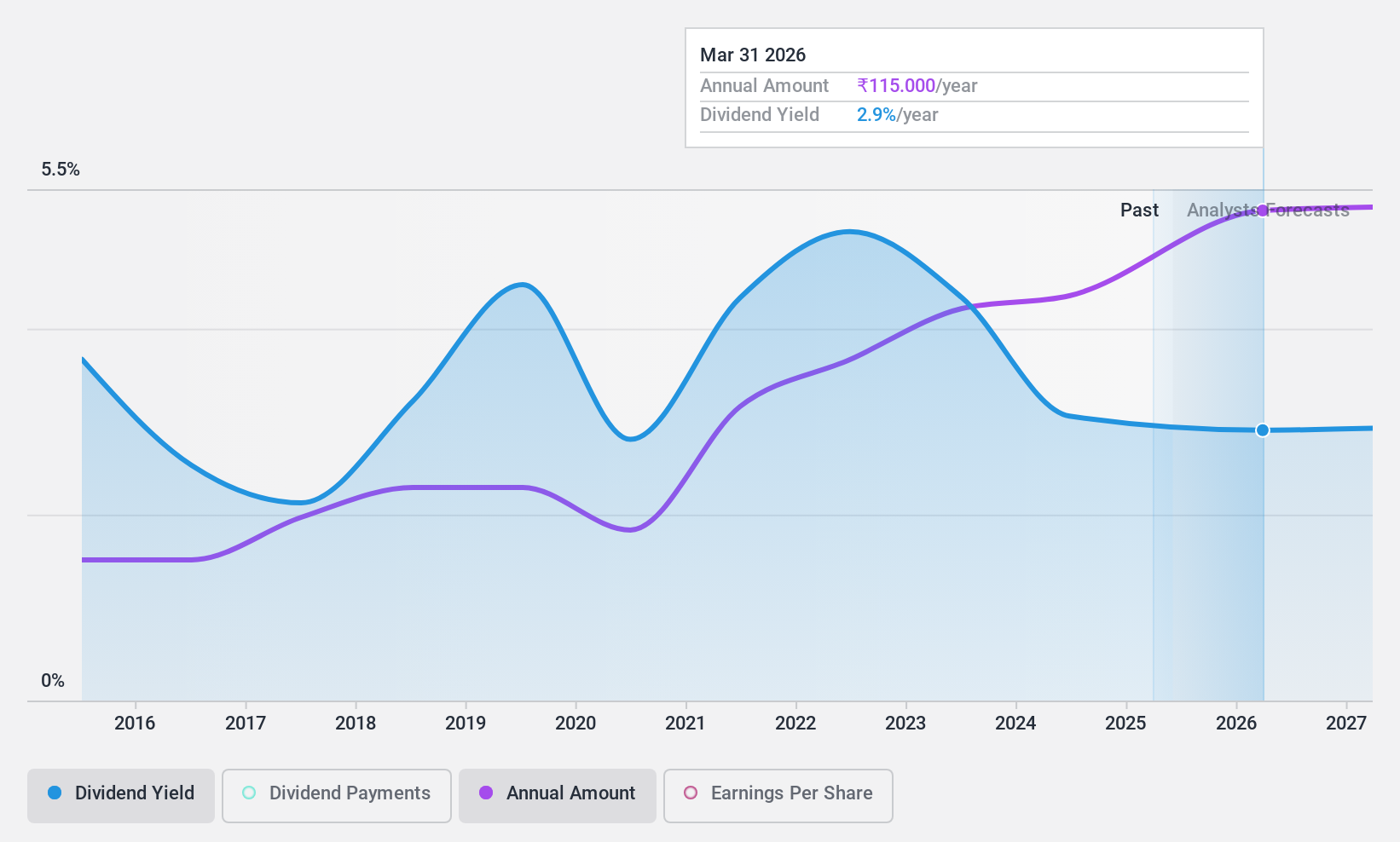

Dividend Yield: 3.2%

Swaraj Engines has shown earnings growth of 15.6% annually over the past five years and reported a net income of ₹431.9 million for Q1 2024. Despite being in the top 25% of dividend payers in India with a yield of 3.17%, its dividends are not well covered by free cash flows, evidenced by a high cash payout ratio (122%). Recent executive changes include appointing Devjit Sarkar as CEO from September 2024.

- Navigate through the intricacies of Swaraj Engines with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Swaraj Engines is priced lower than what may be justified by its financials.

Ujjivan Small Finance Bank (NSEI:UJJIVANSFB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ujjivan Small Finance Bank Limited offers a range of banking and financial services in India, with a market cap of ₹81.92 billion.

Operations: Ujjivan Small Finance Bank Limited generates revenue from Treasury operations (₹7.58 billion), Retail Banking (₹58.71 billion), and Wholesale Banking (₹1.44 billion).

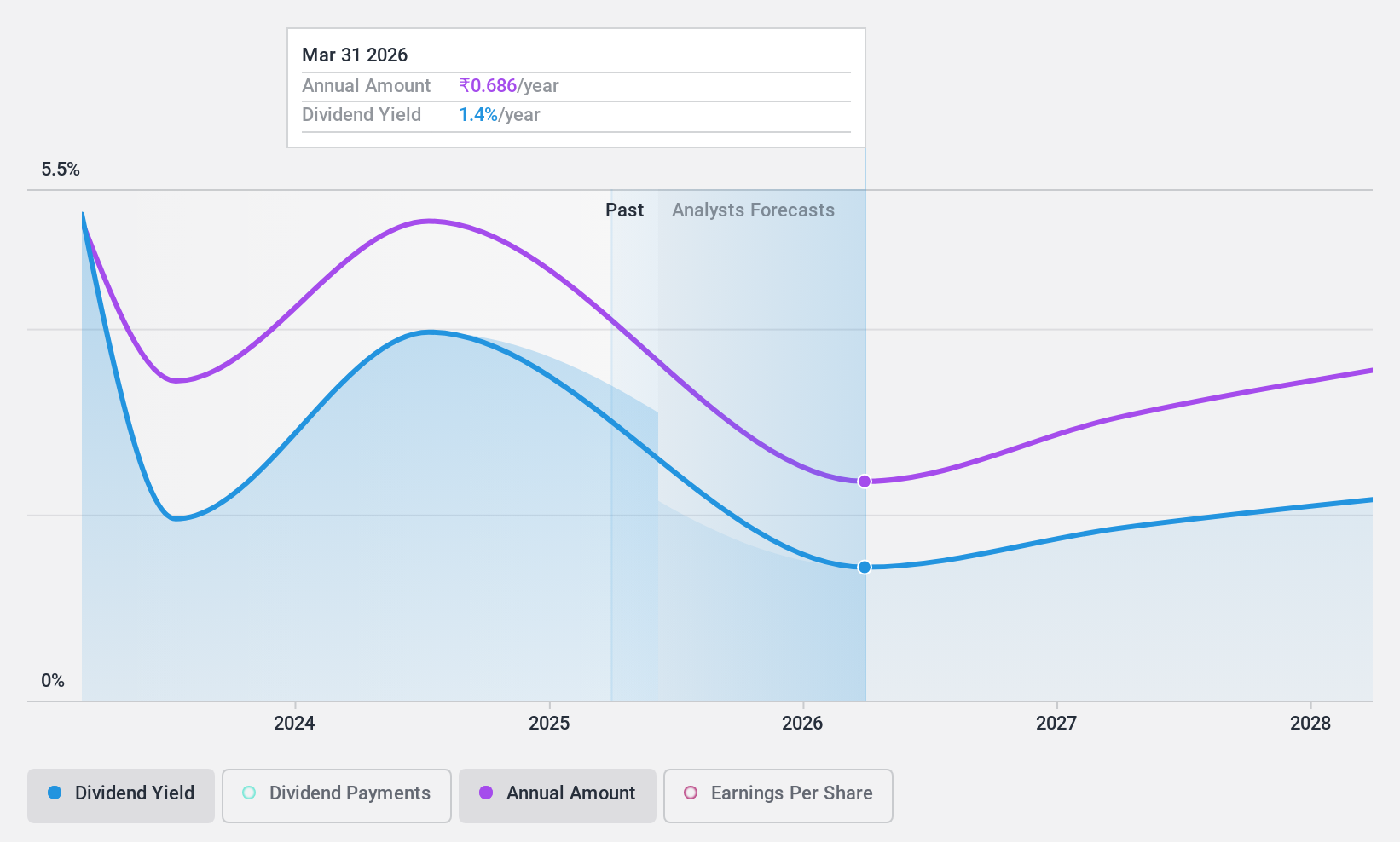

Dividend Yield: 3.5%

Ujjivan Small Finance Bank's dividend yield of 3.54% places it among the top 25% of Indian dividend payers. However, with a high level of bad loans (2.3%) and an unstable dividend track record, caution is advised. The bank’s dividends are currently well covered by earnings (22.6% payout ratio) and forecasted to remain so in three years (16.1%). Recent changes include appointing Deloitte Haskins & Sells as joint statutory auditors and altering the Articles of Association following a merger completion.

- Take a closer look at Ujjivan Small Finance Bank's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ujjivan Small Finance Bank shares in the market.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, with a market cap of ₹22.24 billion, manufactures and sells engineering systems, solutions, assemblies, and components for off-highway vehicles across India and internationally.

Operations: Uniparts India Limited generates revenue of ₹11.40 billion from linkage parts and components for off-highway vehicles.

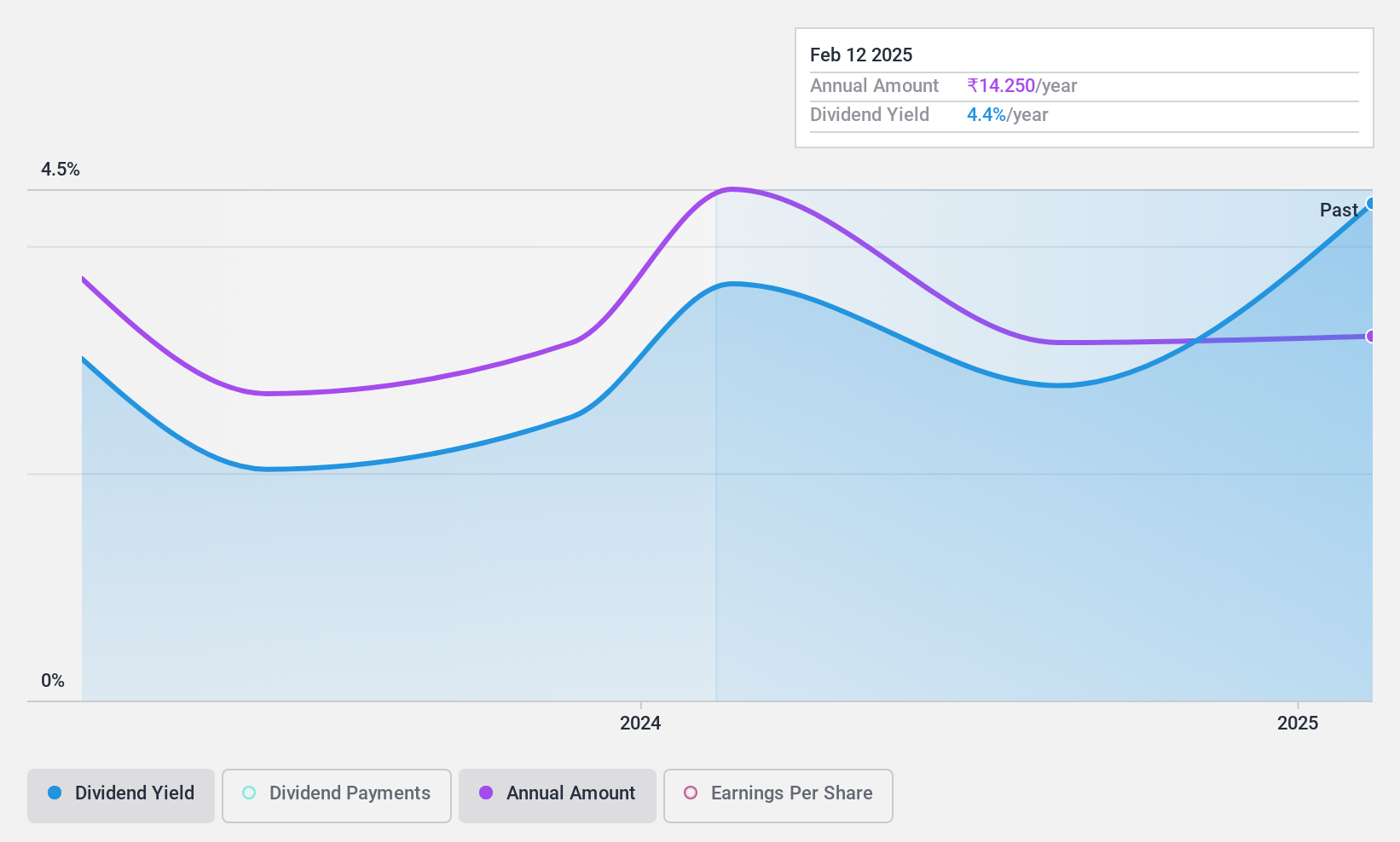

Dividend Yield: 4%

Uniparts India's dividend yield of 3.97% ranks it in the top 25% of Indian dividend payers. Despite a recent interim dividend declaration of INR 6.75 per share, the company's unstable and nascent dividend track record warrants caution. Dividends are covered by earnings (62.6% payout ratio) and cash flows (53.9%). Trading at a P/E ratio of 17.8x, below the market average, Uniparts shows good relative value despite declining Q1 earnings and revenue compared to last year.

- Click to explore a detailed breakdown of our findings in Uniparts India's dividend report.

- Our expertly prepared valuation report Uniparts India implies its share price may be lower than expected.

Turning Ideas Into Actions

- Navigate through the entire inventory of 18 Top Indian Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SWARAJENG

Swaraj Engines

Manufactures and sells diesel engines and its engine components, hi-tech engine, and spare parts for tractors in India.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives