Does R M Drip and Sprinklers Systems (NSE:RMDRIP) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like R M Drip and Sprinklers Systems (NSE:RMDRIP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide R M Drip and Sprinklers Systems with the means to add long-term value to shareholders.

Check out our latest analysis for R M Drip and Sprinklers Systems

How Fast Is R M Drip and Sprinklers Systems Growing Its Earnings Per Share?

Over the last three years, R M Drip and Sprinklers Systems has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, R M Drip and Sprinklers Systems' EPS grew from ₹2.15 to ₹5.54, over the previous 12 months. Year on year growth of 158% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. R M Drip and Sprinklers Systems shareholders can take confidence from the fact that EBIT margins are up from 14% to 16%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

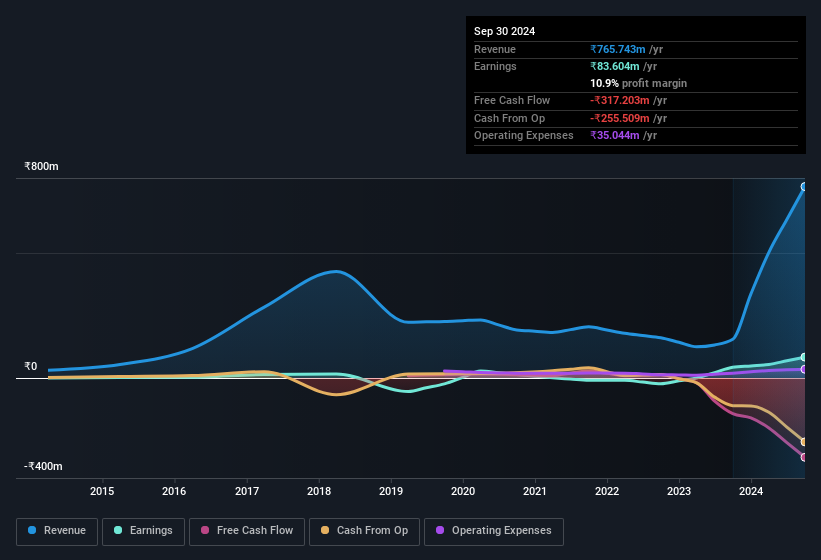

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

R M Drip and Sprinklers Systems isn't a huge company, given its market capitalisation of ₹5.5b. That makes it extra important to check on its balance sheet strength.

Are R M Drip and Sprinklers Systems Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that R M Drip and Sprinklers Systems insiders own a significant number of shares certainly is appealing. Owning 38% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about ₹2.1b riding on the stock, at current prices. So there's plenty there to keep them focused!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to R M Drip and Sprinklers Systems, with market caps under ₹17b is around ₹3.7m.

The CEO of R M Drip and Sprinklers Systems was paid just ₹60k in total compensation for the year ending March 2024. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is R M Drip and Sprinklers Systems Worth Keeping An Eye On?

R M Drip and Sprinklers Systems' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. R M Drip and Sprinklers Systems is certainly doing some things right and is well worth investigating. Even so, be aware that R M Drip and Sprinklers Systems is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RMDRIP

R M Drip and Sprinklers Systems

Designs, manufactures, and sells micro irrigation equipment and components in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives