Does R M Drip and Sprinklers Systems (NSE:RMDRIP) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in R M Drip and Sprinklers Systems (NSE:RMDRIP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for R M Drip and Sprinklers Systems

R M Drip and Sprinklers Systems' Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for R M Drip and Sprinklers Systems to have grown EPS from ₹0.043 to ₹3.59 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that, last year, R M Drip and Sprinklers Systems' revenue from operations was lower than its revenue, so that could distort our analysis of its margins. The good news is that R M Drip and Sprinklers Systems is growing revenues, and EBIT margins improved by 17.8 percentage points to 15%, over the last year. Both of which are great metrics to check off for potential growth.

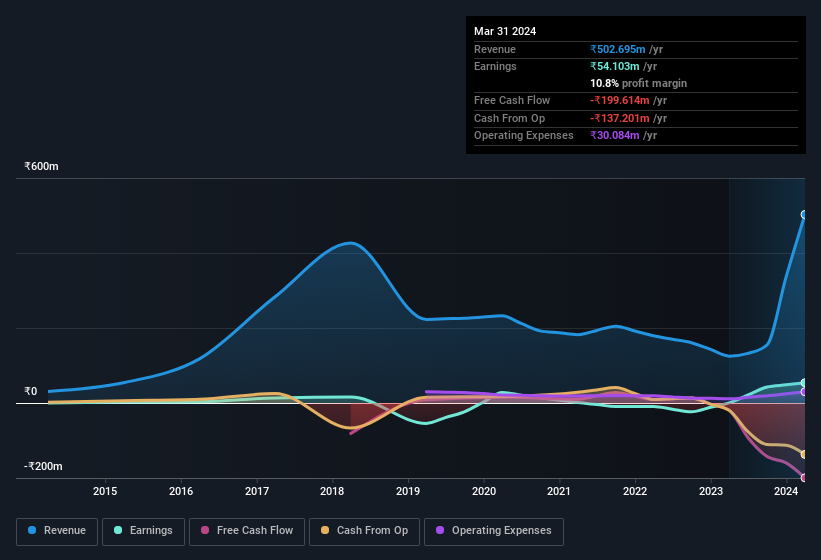

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since R M Drip and Sprinklers Systems is no giant, with a market capitalisation of ₹4.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are R M Drip and Sprinklers Systems Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own R M Drip and Sprinklers Systems shares worth a considerable sum. Indeed, they hold ₹1.2b worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 29% of the company, demonstrating a degree of high-level alignment with shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to R M Drip and Sprinklers Systems, with market caps under ₹17b is around ₹3.6m.

R M Drip and Sprinklers Systems' CEO only received compensation totalling ₹60k in the year to March 2024. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does R M Drip and Sprinklers Systems Deserve A Spot On Your Watchlist?

R M Drip and Sprinklers Systems' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that R M Drip and Sprinklers Systems is worth considering carefully. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for R M Drip and Sprinklers Systems (1 is a bit unpleasant) you should be aware of.

Although R M Drip and Sprinklers Systems certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RMDRIP

R M Drip and Sprinklers Systems

Designs, manufactures, and sells micro irrigation equipment and components in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives