- India

- /

- Electrical

- /

- NSEI:POWERINDIA

Subdued Growth No Barrier To Hitachi Energy India Limited (NSE:POWERINDIA) With Shares Advancing 26%

Hitachi Energy India Limited (NSE:POWERINDIA) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 231% following the latest surge, making investors sit up and take notice.

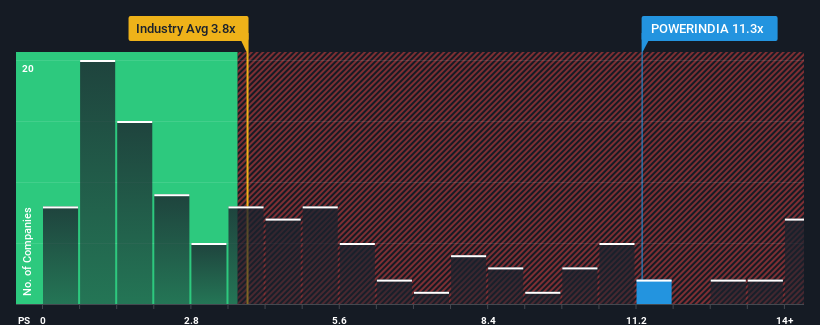

Since its price has surged higher, Hitachi Energy India's price-to-sales (or "P/S") ratio of 11.3x might make it look like a strong sell right now compared to other companies in the Electrical industry in India, where around half of the companies have P/S ratios below 3.8x and even P/S below 1.6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Hitachi Energy India

What Does Hitachi Energy India's P/S Mean For Shareholders?

Recent times haven't been great for Hitachi Energy India as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hitachi Energy India.How Is Hitachi Energy India's Revenue Growth Trending?

In order to justify its P/S ratio, Hitachi Energy India would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 22% per year, which is not materially different.

In light of this, it's curious that Hitachi Energy India's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Hitachi Energy India's P/S

Hitachi Energy India's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Hitachi Energy India's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hitachi Energy India you should know about.

If you're unsure about the strength of Hitachi Energy India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi Energy India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:POWERINDIA

Hitachi Energy India

Offers products, projects, and services for electricity transmission and related activities in India and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives