- India

- /

- Aerospace & Defense

- /

- NSEI:PARAS

Paras Defence and Space Technologies Limited's (NSE:PARAS) Shares May Have Run Too Fast Too Soon

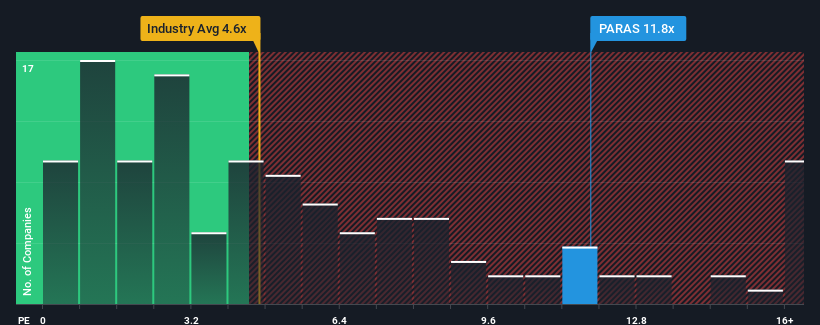

When close to half the companies in the Aerospace & Defense industry in India have price-to-sales ratios (or "P/S") below 7.2x, you may consider Paras Defence and Space Technologies Limited (NSE:PARAS) as a stock to avoid entirely with its 11.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Paras Defence and Space Technologies

How Paras Defence and Space Technologies Has Been Performing

The revenue growth achieved at Paras Defence and Space Technologies over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Paras Defence and Space Technologies' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Paras Defence and Space Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 9.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 66% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Paras Defence and Space Technologies' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Paras Defence and Space Technologies' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Paras Defence and Space Technologies currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Paras Defence and Space Technologies with six simple checks.

If you're unsure about the strength of Paras Defence and Space Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PARAS

Paras Defence and Space Technologies

Designs, develops, manufactures, and tests defense and space engineering products and solutions in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives