- India

- /

- Construction

- /

- NSEI:NIRAJ

Does Niraj Cement Structurals (NSE:NIRAJ) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Niraj Cement Structurals (NSE:NIRAJ), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Niraj Cement Structurals

Niraj Cement Structurals' Improving Profits

Over the last three years, Niraj Cement Structurals has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Niraj Cement Structurals' EPS grew from ₹1.17 to ₹2.78, over the previous 12 months. It's a rarity to see 137% year-on-year growth like that.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Niraj Cement Structurals' EBIT margins are flat but, worryingly, its revenue is actually down. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

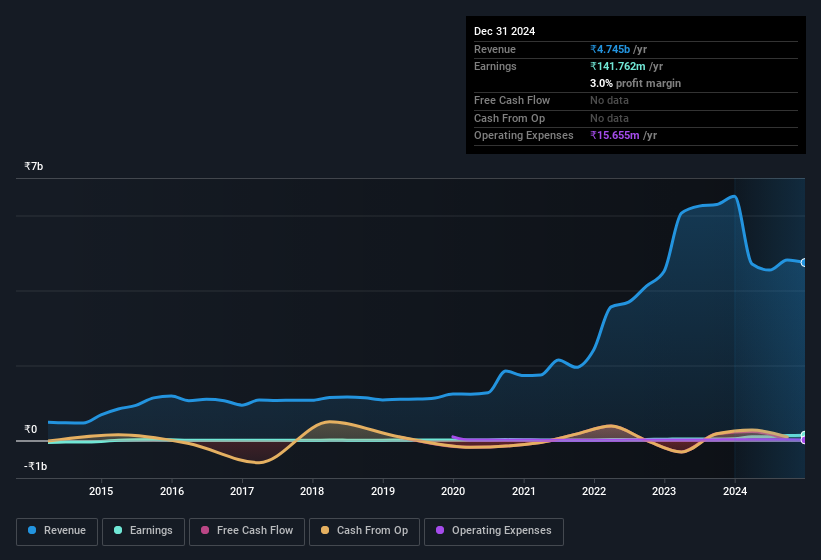

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Niraj Cement Structurals isn't a huge company, given its market capitalisation of ₹3.0b. That makes it extra important to check on its balance sheet strength.

Are Niraj Cement Structurals Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Niraj Cement Structurals insiders spent a staggering ₹277m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. Zooming in, we can see that the biggest insider purchase was by company insider Gulshan Chopra for ₹68m worth of shares, at about ₹53.00 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Niraj Cement Structurals will reveal that insiders own a significant piece of the pie. In fact, they own 40% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Of course, Niraj Cement Structurals is a very small company, with a market cap of only ₹3.0b. So despite a large proportional holding, insiders only have ₹1.2b worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Vishram Rudre, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Niraj Cement Structurals, with market caps under ₹17b is around ₹3.7m.

The Niraj Cement Structurals CEO received total compensation of only ₹305k in the year to March 2024. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Niraj Cement Structurals Worth Keeping An Eye On?

Niraj Cement Structurals' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Niraj Cement Structurals deserves timely attention. You still need to take note of risks, for example - Niraj Cement Structurals has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Keen growth investors love to see insider activity. Thankfully, Niraj Cement Structurals isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Niraj Cement Structurals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIRAJ

Niraj Cement Structurals

Niraj Cement Structurals Limited executes various civil construction and infrastructure projects in India.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion