- India

- /

- Aerospace & Defense

- /

- NSEI:APOLLO

Discovering 3 Hidden Stock Gems in India with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.3% drop, yet it has risen by an impressive 41% over the past year with earnings expected to grow by 18% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems that may offer promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

| Sky Gold | 135.31% | 22.02% | 48.03% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Apollo Micro Systems (NSEI:APOLLO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Apollo Micro Systems Limited designs, develops, and assembles electronic and electro-mechanical solutions in India, with a market capitalization of ₹30.18 billion.

Operations: The primary revenue stream for Apollo Micro Systems Limited comes from its Electromechanical Components and Systems and Allied Components and Services segment, generating ₹4.05 billion.

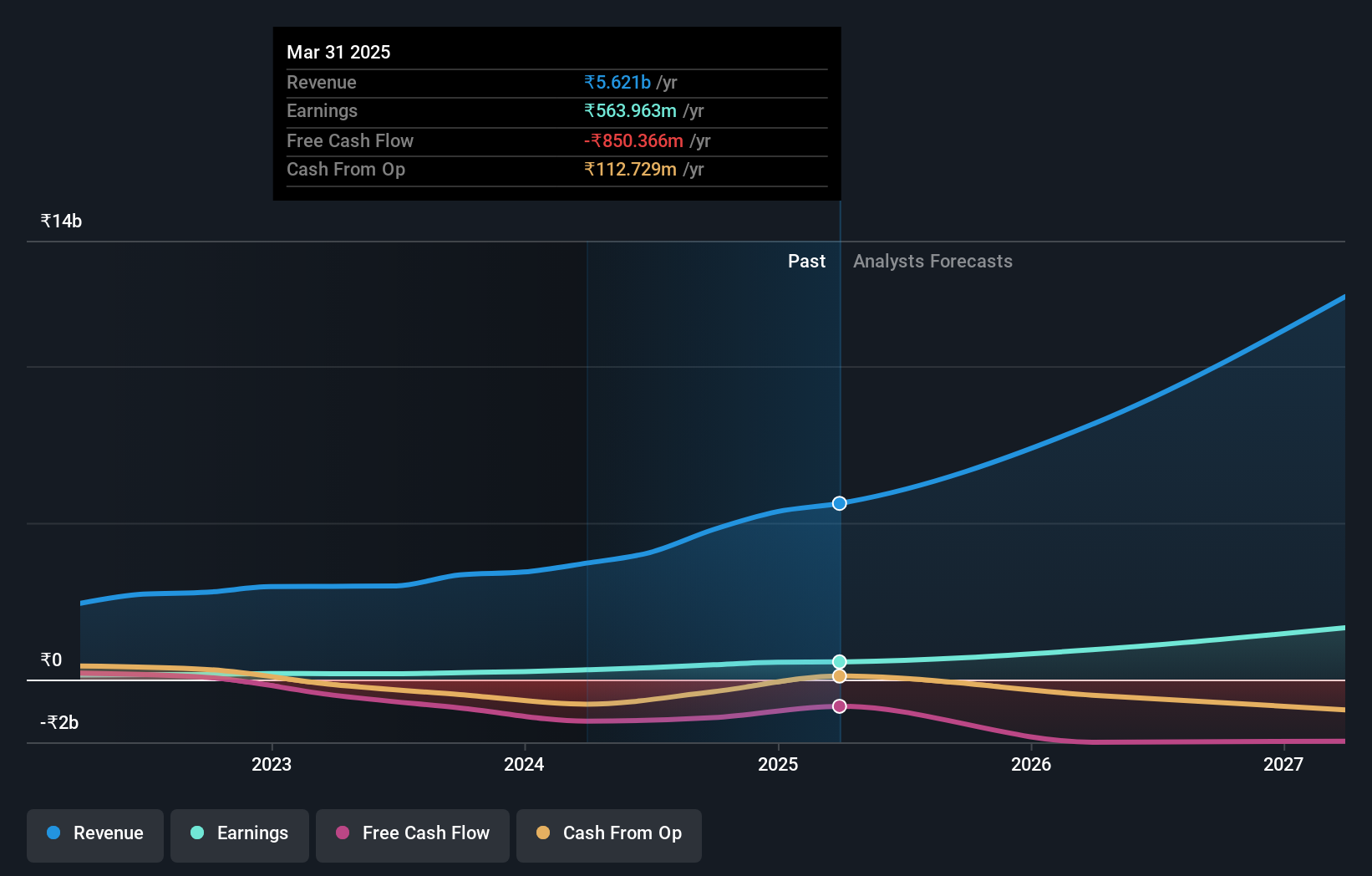

Apollo Micro Systems, a dynamic player in India's defense sector, has shown impressive growth with earnings surging 101.9% over the past year, outpacing the industry average of 53.8%. The company's net debt to equity ratio stands at a satisfactory 33.2%, reflecting prudent financial management over five years as it decreased from 41% to 38.5%. Despite these strengths, interest coverage remains tight at 2.7 times EBIT against interest payments. Recent developments include being shortlisted for technology transfer by DRDO and securing orders worth millions for advanced defense systems, highlighting its strategic role in India's defense modernization efforts.

Innova Captab (NSEI:INNOVACAP)

Simply Wall St Value Rating: ★★★★★★

Overview: Innova Captab Limited is an integrated pharmaceutical company involved in the research and development, manufacture, distribution, and marketing of drugs both in India and internationally, with a market capitalization of ₹41.57 billion.

Operations: Innova Captab generates revenue primarily from its drugs and pharmaceutical products segment, totaling ₹11.42 billion.

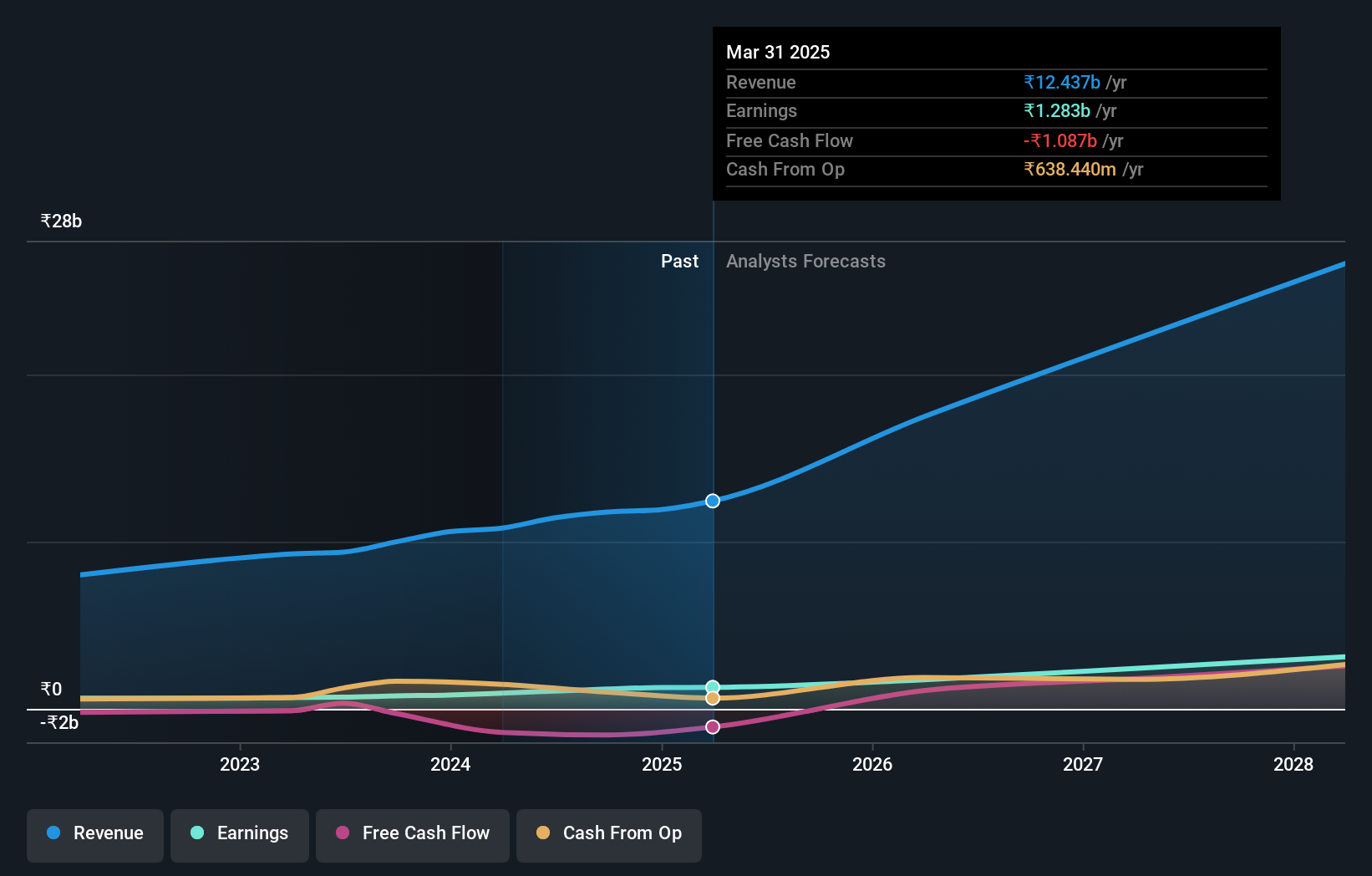

Innova Captab, a promising player in India's life sciences sector, has shown remarkable growth with earnings surging 51.8% over the past year, outpacing the industry average of 13.3%. Despite not being free cash flow positive recently, its net debt to equity ratio stands at a satisfactory 19.4%, having improved from 75.6% five years ago. The company's price-to-earnings ratio of 39.1x is attractive compared to the industry average of 51.1x, suggesting it offers good value for investors seeking opportunities in this space. Notably, Innova was recently added to the S&P Global BMI Index on September 23, enhancing its visibility among global investors.

- Click to explore a detailed breakdown of our findings in Innova Captab's health report.

Explore historical data to track Innova Captab's performance over time in our Past section.

L.G. Balakrishnan & Bros (NSEI:LGBBROSLTD)

Simply Wall St Value Rating: ★★★★★★

Overview: L.G. Balakrishnan & Bros Limited is engaged in the manufacturing and sale of transmission chains, sprockets, and metal formed parts for both automotive and industrial applications globally, with a market capitalization of ₹41.55 billion.

Operations: L.G. Balakrishnan & Bros generates revenue primarily from its transmission segment, contributing ₹18.74 billion, and its metal forming segment, adding ₹5.05 billion. The company's net profit margin exhibits notable trends over recent periods, offering insights into profitability dynamics within these segments.

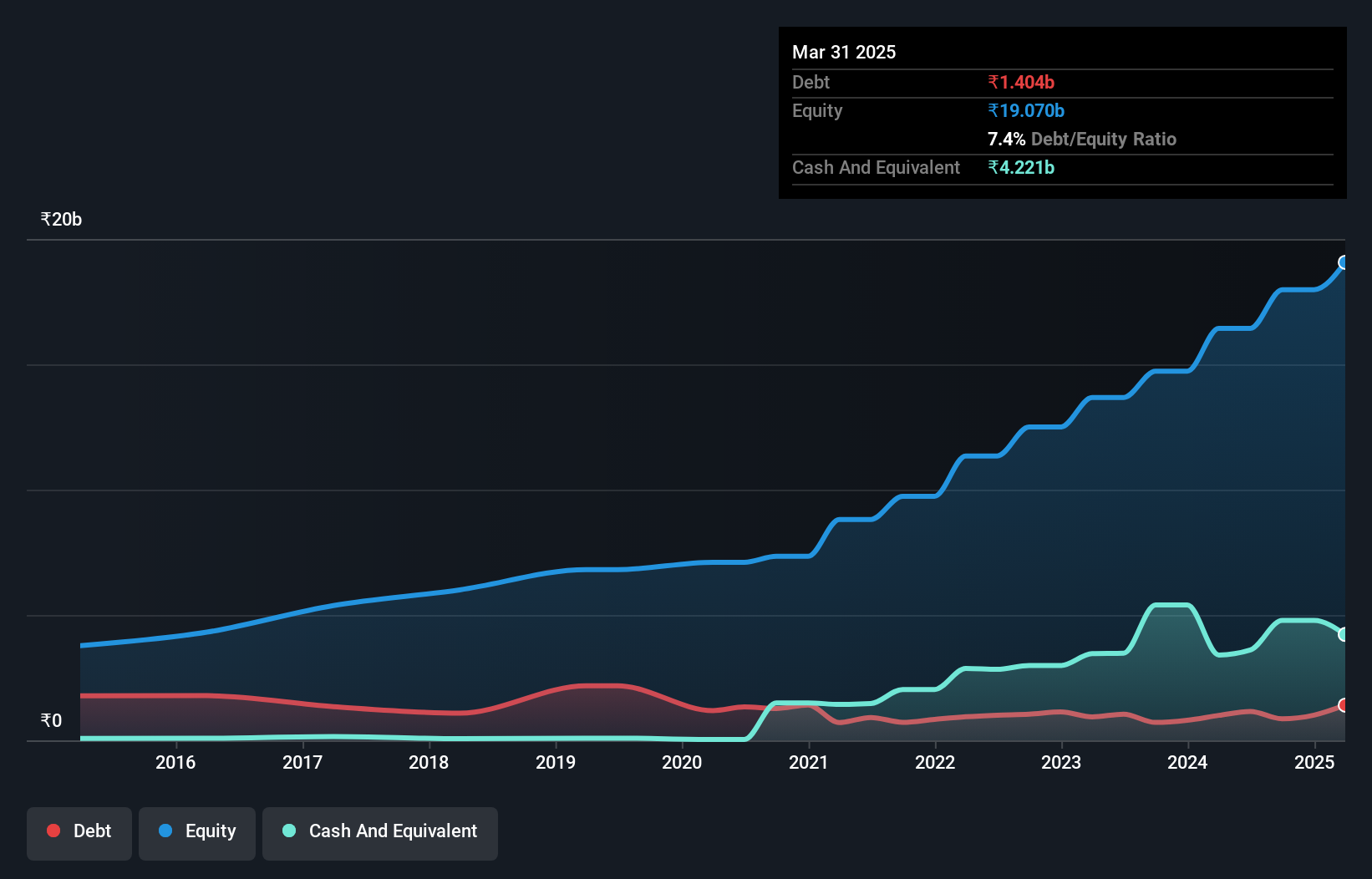

L.G. Balakrishnan & Bros, a notable player in the Indian market, offers an attractive value proposition with its price-to-earnings ratio at 14.8x, significantly lower than the market's 32.7x. The company's financial health is underscored by high-quality earnings and robust interest coverage of 36.9 times EBIT over interest payments. Over the past five years, earnings have consistently grown by 25% annually, while debt levels have impressively reduced from a debt-to-equity ratio of 32% to just 7%. Recent moves include strategic investments and board changes that could influence future growth trajectories positively.

- Click here and access our complete health analysis report to understand the dynamics of L.G. Balakrishnan & Bros.

Gain insights into L.G. Balakrishnan & Bros' past trends and performance with our Past report.

Summing It All Up

- Delve into our full catalog of 456 Indian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:APOLLO

Apollo Micro Systems

Designs, develops, and assembles electronic and electromechanical solutions in India.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives