Kirloskar Pneumatic Company Limited's (NSE:KIRLPNU) Stock Retreats 26% But Earnings Haven't Escaped The Attention Of Investors

Unfortunately for some shareholders, the Kirloskar Pneumatic Company Limited (NSE:KIRLPNU) share price has dived 26% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 63%, which is great even in a bull market.

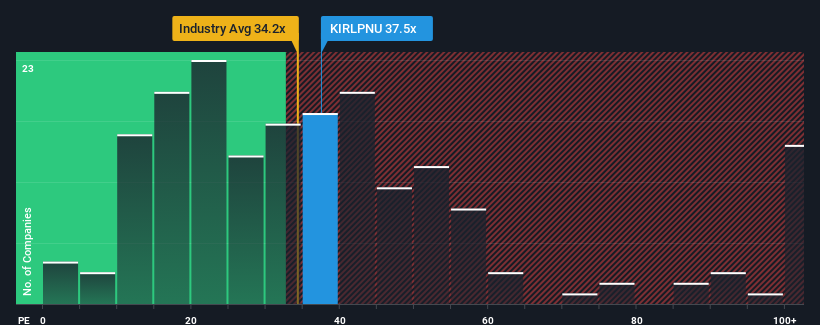

Even after such a large drop in price, Kirloskar Pneumatic's price-to-earnings (or "P/E") ratio of 37.5x might still make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 28x and even P/E's below 16x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, Kirloskar Pneumatic has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Kirloskar Pneumatic

How Is Kirloskar Pneumatic's Growth Trending?

Kirloskar Pneumatic's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 81% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 135% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 32% during the coming year according to the three analysts following the company. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

With this information, we can see why Kirloskar Pneumatic is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Kirloskar Pneumatic's P/E?

There's still some solid strength behind Kirloskar Pneumatic's P/E, if not its share price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kirloskar Pneumatic maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Kirloskar Pneumatic that you should be aware of.

If these risks are making you reconsider your opinion on Kirloskar Pneumatic, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kirloskar Pneumatic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIRLPNU

Kirloskar Pneumatic

Engages in the design, manufacture, and supply industrial air compressors, gas compressors, and pneumatic tools in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives