Kirloskar Pneumatic Company Limited's (NSE:KIRLPNU) 31% Jump Shows Its Popularity With Investors

Those holding Kirloskar Pneumatic Company Limited (NSE:KIRLPNU) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 96%.

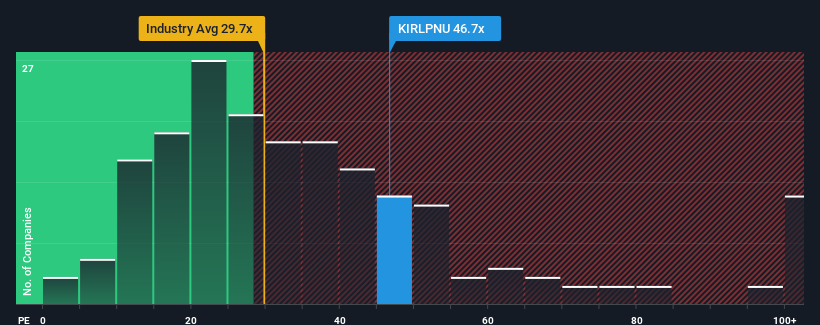

Since its price has surged higher, Kirloskar Pneumatic's price-to-earnings (or "P/E") ratio of 46.7x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 25x and even P/E's below 14x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Kirloskar Pneumatic as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Kirloskar Pneumatic

Does Growth Match The High P/E?

In order to justify its P/E ratio, Kirloskar Pneumatic would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 81% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 135% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

With this information, we can see why Kirloskar Pneumatic is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Kirloskar Pneumatic's P/E?

The strong share price surge has got Kirloskar Pneumatic's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kirloskar Pneumatic maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Kirloskar Pneumatic that you need to take into consideration.

If these risks are making you reconsider your opinion on Kirloskar Pneumatic, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kirloskar Pneumatic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIRLPNU

Kirloskar Pneumatic

Engages in the design, manufacture, and supply industrial air compressors, gas compressors, and pneumatic tools in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives