- India

- /

- Construction

- /

- NSEI:KEC

Why We Think KEC International Limited's (NSE:KEC) CEO Compensation Is Not Excessive At All

Key Insights

- KEC International's Annual General Meeting to take place on 22nd of August

- CEO Vimal Kejriwal's total compensation includes salary of ₹71.7m

- Total compensation is similar to the industry average

- KEC International's EPS declined by 9.4% over the past three years while total shareholder return over the past three years was 107%

The share price of KEC International Limited (NSE:KEC) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 22nd of August. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for KEC International

Comparing KEC International Limited's CEO Compensation With The Industry

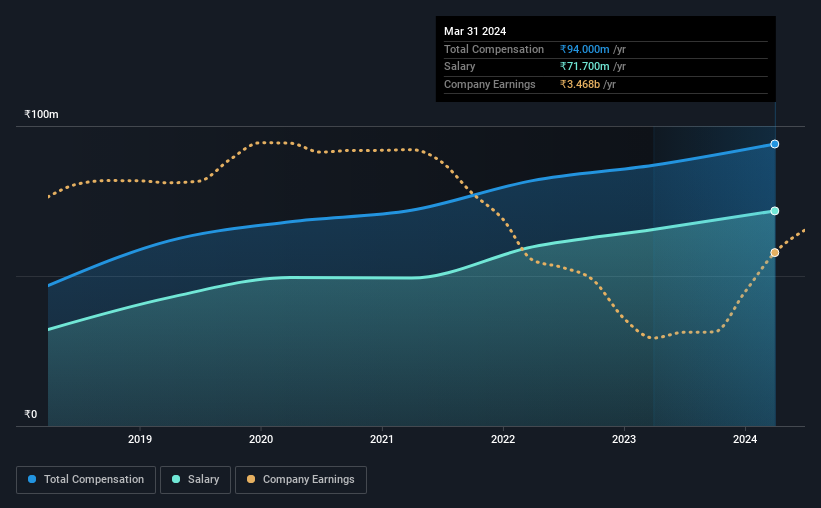

Our data indicates that KEC International Limited has a market capitalization of ₹209b, and total annual CEO compensation was reported as ₹94m for the year to March 2024. Notably, that's an increase of 8.2% over the year before. We note that the salary portion, which stands at ₹71.7m constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the Indian Construction industry with market caps ranging from ₹168b to ₹537b, we found that the median CEO total compensation was ₹93m. From this we gather that Vimal Kejriwal is paid around the median for CEOs in the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹72m | ₹66m | 76% |

| Other | ₹22m | ₹21m | 24% |

| Total Compensation | ₹94m | ₹87m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. KEC International pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

KEC International Limited's Growth

Over the last three years, KEC International Limited has shrunk its earnings per share by 9.4% per year. It achieved revenue growth of 11% over the last year.

Few shareholders would be pleased to read that EPS have declined. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has KEC International Limited Been A Good Investment?

We think that the total shareholder return of 107%, over three years, would leave most KEC International Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for KEC International (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: KEC International is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if KEC International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KEC

KEC International

Engages in the engineering, procurement, and construction (EPC) business.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives