Stock Analysis

- India

- /

- Construction

- /

- NSEI:KEC

KEC International Limited (NSE:KEC) Just Reported Third-Quarter Earnings: Have Analysts Changed Their Mind On The Stock?

Last week saw the newest third-quarter earnings release from KEC International Limited (NSE:KEC), an important milestone in the company's journey to build a stronger business. Results look mixed - while revenue fell marginally short of analyst estimates at ₹33b, statutory earnings were in line with expectations, at ₹5.64 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on KEC International after the latest results.

See our latest analysis for KEC International

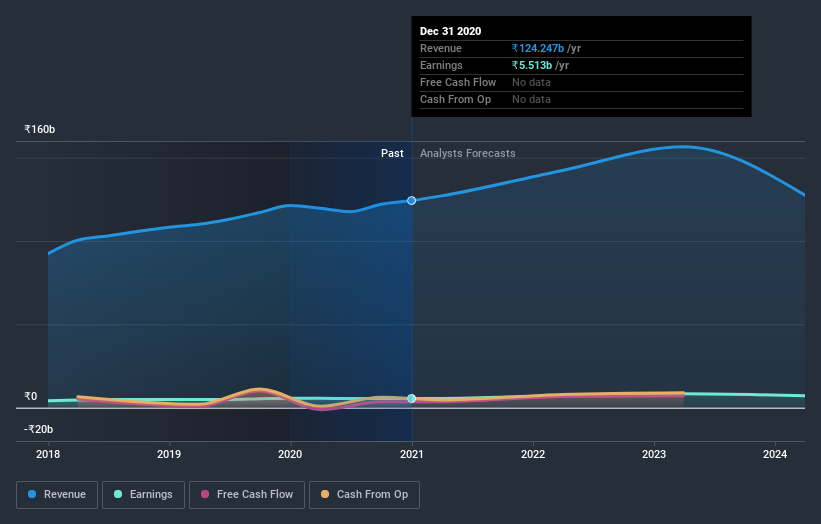

Taking into account the latest results, the most recent consensus for KEC International from 21 analysts is for revenues of ₹142.4b in 2022 which, if met, would be a decent 15% increase on its sales over the past 12 months. Statutory earnings per share are predicted to soar 30% to ₹27.81. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹141.9b and earnings per share (EPS) of ₹27.92 in 2022. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

There were no changes to revenue or earnings estimates or the price target of ₹390, suggesting that the company has met expectations in its recent result. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on KEC International, with the most bullish analyst valuing it at ₹491 and the most bearish at ₹271 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the KEC International's past performance and to peers in the same industry. The analysts are definitely expecting KEC International's growth to accelerate, with the forecast 15% growth ranking favourably alongside historical growth of 9.4% per annum over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 15% per year. KEC International is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Happily, there were no real changes to sales forecasts, with the business still expected to grow in line with the overall industry. The consensus price target held steady at ₹390, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on KEC International. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple KEC International analysts - going out to 2024, and you can see them free on our platform here.

Even so, be aware that KEC International is showing 2 warning signs in our investment analysis , you should know about...

If you’re looking to trade KEC International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether KEC International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KEC

KEC International

Engages in the engineering, procurement, and construction (EPC) business.

High growth potential with proven track record.