3 Growth Companies With High Insider Ownership On The Indian Exchange

Reviewed by Simply Wall St

The Indian market has seen a 1.0% increase in the last 7 days and an impressive 45% rise over the past year, with earnings projected to grow by 17% annually in the coming years. In this favorable environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 19.1% | 22.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

We'll examine a selection from our screener results.

Heritage Foods (NSEI:HERITGFOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Foods Limited procures and processes milk and milk products in India, with a market cap of ₹51.22 billion.

Operations: The company's revenue segments consist of ₹38.40 billion from Dairy, ₹1.70 billion from Feed, and ₹90.04 million from Renewable Energy.

Insider Ownership: 37%

Revenue Growth Forecast: 11.3% p.a.

Heritage Foods has demonstrated strong growth, with earnings rising by 119.8% over the past year and revenue for Q1 2024 reaching ₹10.38 billion, up from ₹9.26 billion a year ago. The company also declared a final dividend of ₹2.50 per share for FY2024 and launched new products like ghee laddus and ice creams in June 2024. Despite high insider ownership, the stock has been highly volatile recently and has an unstable dividend track record.

- Click here to discover the nuances of Heritage Foods with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Heritage Foods' current price could be inflated.

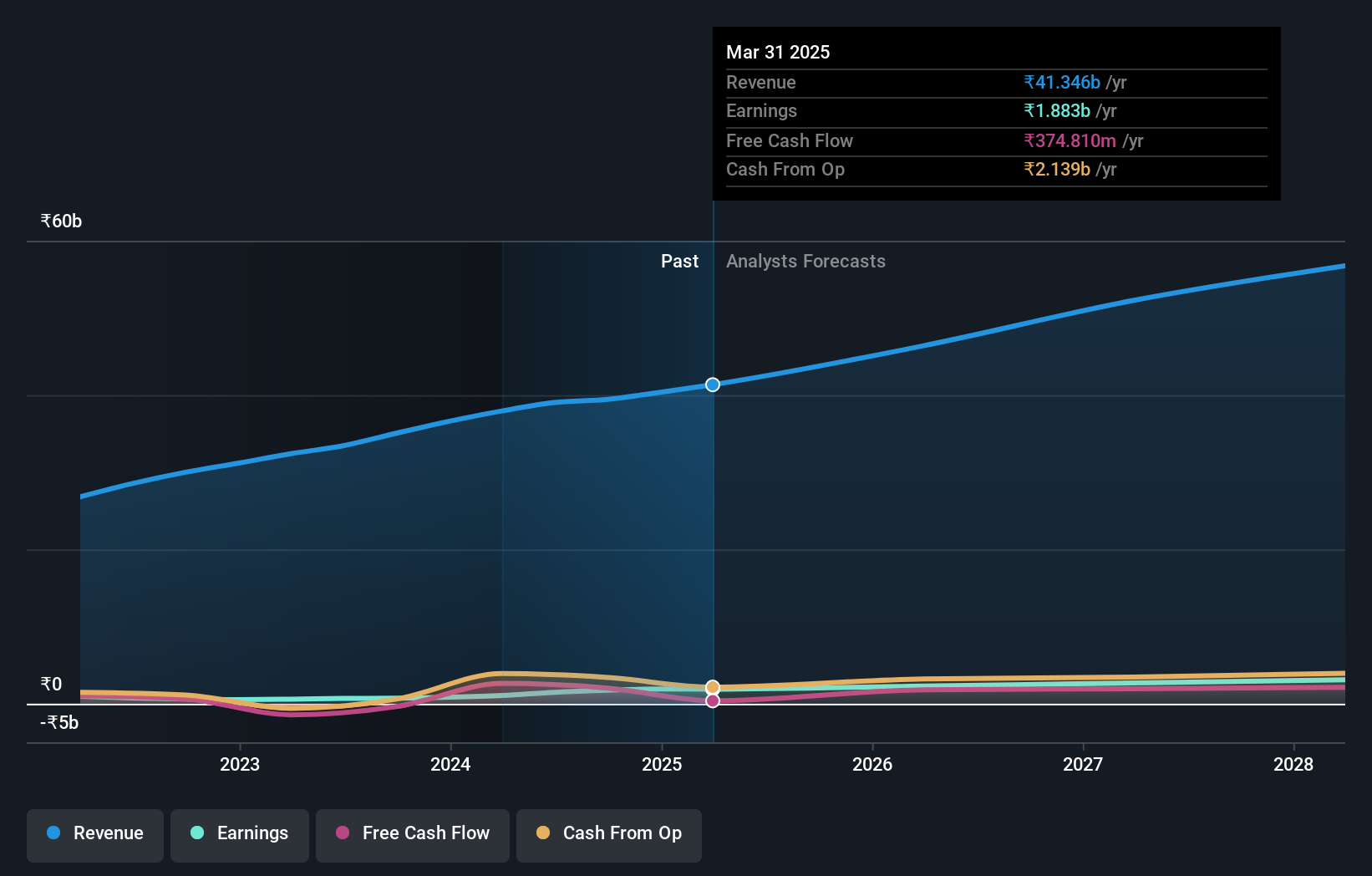

Jupiter Wagons (NSEI:JWL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jupiter Wagons Limited manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally, with a market cap of ₹235.89 billion.

Operations: The company's revenue segments include ₹37.70 billion from Auto Manufacturers.

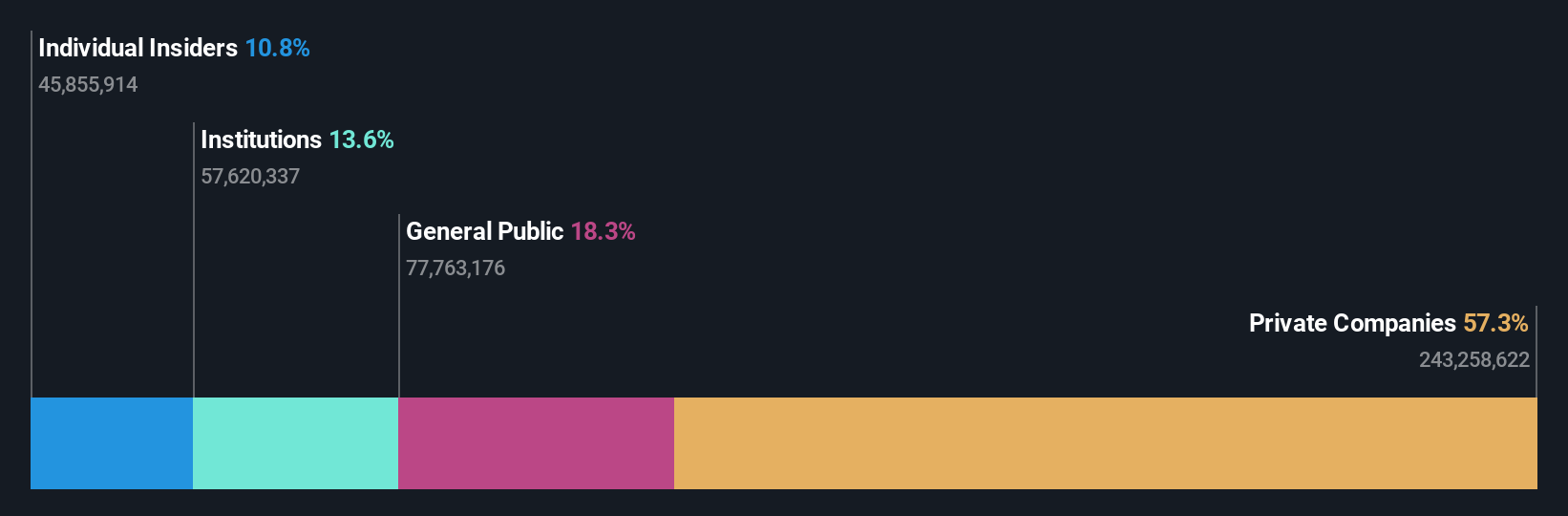

Insider Ownership: 10.8%

Revenue Growth Forecast: 23.3% p.a.

Jupiter Wagons has shown substantial growth, with earnings increasing by 111.2% over the past year and forecasted to grow at 27.21% annually. Revenue is expected to rise by 23.3% per year, outpacing the broader Indian market's growth rate of 10%. Despite high insider ownership and significant recent equity offerings totaling ₹8 billion, the stock has been highly volatile over the past three months and shareholders have experienced dilution in the past year.

- Take a closer look at Jupiter Wagons' potential here in our earnings growth report.

- Our expertly prepared valuation report Jupiter Wagons implies its share price may be too high.

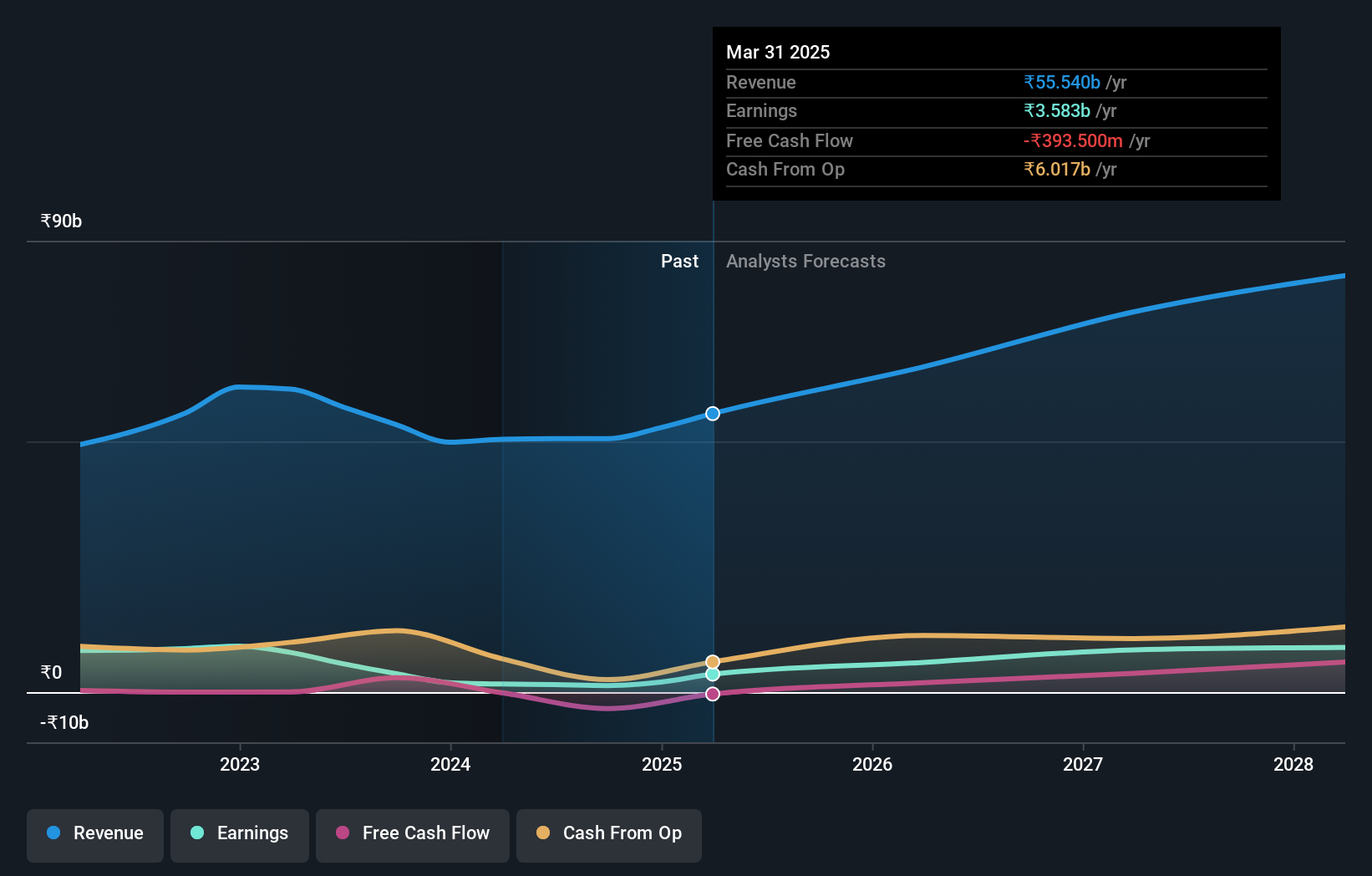

Laurus Labs (NSEI:LAURUSLABS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Laurus Labs Limited, with a market cap of ₹249.36 billion, manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally through its subsidiaries.

Operations: Laurus Labs generates revenue primarily from the manufacture of active pharmaceutical ingredients, intermediates, and formulations totaling ₹50.54 billion.

Insider Ownership: 27.8%

Revenue Growth Forecast: 13.9% p.a.

Laurus Labs is forecast to grow its revenue by 13.9% annually, faster than the Indian market's 10%. Earnings are expected to rise significantly at 50.8% per year, despite recent financial results showing a decline in net income from ₹248.5 million to ₹125.1 million for Q1 2024. Profit margins have also decreased from 9.9% to 2.9%. The company faces challenges with interest payments not well covered by earnings but maintains high insider ownership and strong growth prospects overall.

- Click here and access our complete growth analysis report to understand the dynamics of Laurus Labs.

- Upon reviewing our latest valuation report, Laurus Labs' share price might be too optimistic.

Make It Happen

- Unlock our comprehensive list of 93 Fast Growing Indian Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JWL

Jupiter Wagons

Manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives