- India

- /

- Construction

- /

- NSEI:JKIL

J. Kumar Infraprojects' (NSE:JKIL) Shareholders Will Receive A Smaller Dividend Than Last Year

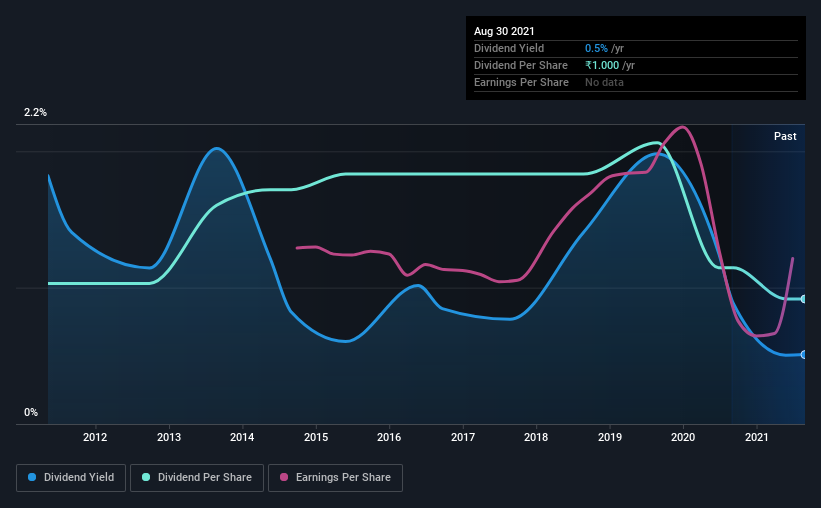

J. Kumar Infraprojects Limited's (NSE:JKIL) dividend is being reduced to ₹1.00 on the 21st of October. Based on this payment, the dividend yield will be 0.5%, which is lower than the average for the industry.

View our latest analysis for J. Kumar Infraprojects

J. Kumar Infraprojects' Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before making this announcement, J. Kumar Infraprojects was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS could expand by 0.7% if recent trends continue. If the dividend continues on this path, the payout ratio could be 5.9% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The first annual payment during the last 10 years was ₹1.13 in 2011, and the most recent fiscal year payment was ₹1.00. Doing the maths, this is a decline of about 1.2% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. However, J. Kumar Infraprojects' EPS was effectively flat over the past five years, which could stop the company from paying more every year. If J. Kumar Infraprojects is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

Our Thoughts On J. Kumar Infraprojects' Dividend

Overall, while it's not great to see that the dividend has been cut, we think the company is now in a good position to make consistent payments going into the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for J. Kumar Infraprojects that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade J. Kumar Infraprojects, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:JKIL

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026