- India

- /

- Construction

- /

- NSEI:HGINFRA

It Looks Like Shareholders Would Probably Approve H.G. Infra Engineering Limited's (NSE:HGINFRA) CEO Compensation Package

Key Insights

- H.G. Infra Engineering will host its Annual General Meeting on 21st of August

- Salary of ₹39.0m is part of CEO Harendra Singh's total remuneration

- The overall pay is comparable to the industry average

- H.G. Infra Engineering's EPS grew by 20% over the past three years while total shareholder return over the past three years was 162%

The performance at H.G. Infra Engineering Limited (NSE:HGINFRA) has been quite strong recently and CEO Harendra Singh has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 21st of August. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for H.G. Infra Engineering

Comparing H.G. Infra Engineering Limited's CEO Compensation With The Industry

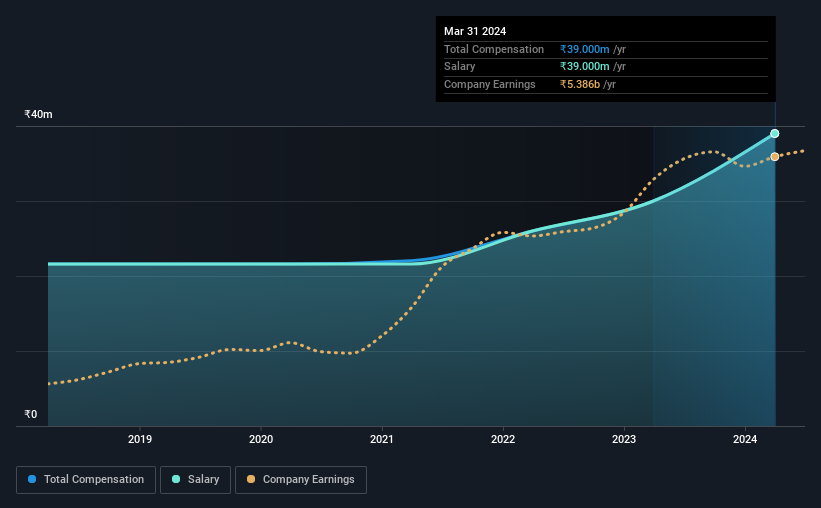

According to our data, H.G. Infra Engineering Limited has a market capitalization of ₹99b, and paid its CEO total annual compensation worth ₹39m over the year to March 2024. That's a notable increase of 30% on last year. Notably, the salary of ₹39m is the entirety of the CEO compensation.

On comparing similar companies from the Indian Construction industry with market caps ranging from ₹34b to ₹134b, we found that the median CEO total compensation was ₹34m. This suggests that H.G. Infra Engineering remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹39m | ₹30m | 100% |

| Other | - | - | - |

| Total Compensation | ₹39m | ₹30m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Speaking on a company level, H.G. Infra Engineering prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

H.G. Infra Engineering Limited's Growth

Over the past three years, H.G. Infra Engineering Limited has seen its earnings per share (EPS) grow by 20% per year. Its revenue is up 14% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has H.G. Infra Engineering Limited Been A Good Investment?

Boasting a total shareholder return of 162% over three years, H.G. Infra Engineering Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

H.G. Infra Engineering rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 2 warning signs for H.G. Infra Engineering you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if H.G. Infra Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HGINFRA

H.G. Infra Engineering

Engages in the engineering, procurement, and construction (EPC) business in India.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026