- India

- /

- Trade Distributors

- /

- NSEI:HEXATRADEX

Market Participants Recognise Hexa Tradex Limited's (NSE:HEXATRADEX) Earnings Pushing Shares 26% Higher

Hexa Tradex Limited (NSE:HEXATRADEX) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

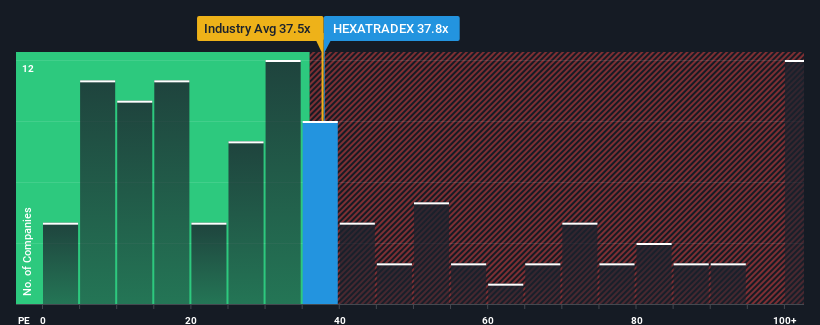

Since its price has surged higher, Hexa Tradex may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 37.8x, since almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Hexa Tradex's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Hexa Tradex

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Hexa Tradex's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. Even so, admirably EPS has lifted 316% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Hexa Tradex is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

The large bounce in Hexa Tradex's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hexa Tradex maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hexa Tradex that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hexa Tradex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HEXATRADEX

Hexa Tradex

Hexa Tradex Limited operate as a dealer, trader, import and export agent, representative, contractor, buyer, seller, and broker in India.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives