- India

- /

- Electrical

- /

- NSEI:HBLENGINE

Do HBL Power Systems's (NSE:HBLPOWER) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like HBL Power Systems (NSE:HBLPOWER). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for HBL Power Systems

HBL Power Systems's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that HBL Power Systems has managed to grow EPS by 35% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

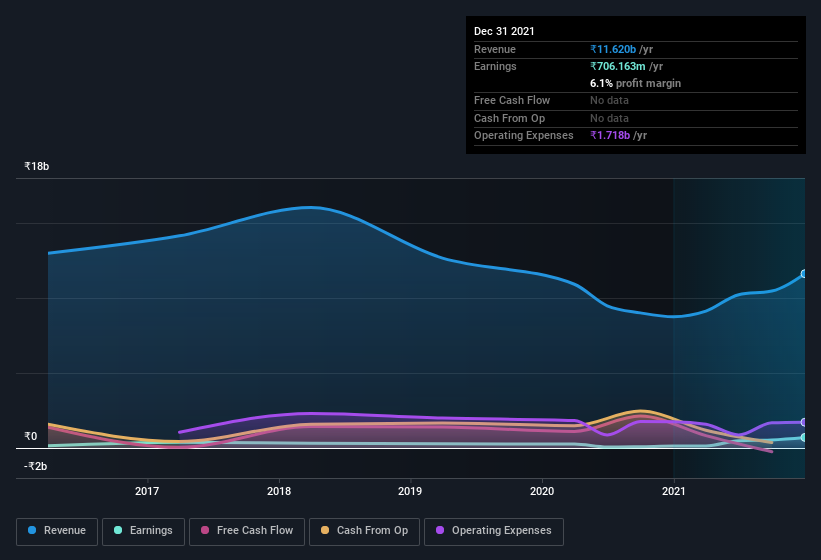

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that HBL Power Systems is growing revenues, and EBIT margins improved by 3.5 percentage points to 6.4%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since HBL Power Systems is no giant, with a market capitalization of ₹20b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are HBL Power Systems Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx HBL Power Systems insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the ₹14m that Founder Aluru Prasad spent buying shares (at an average price of about ₹51.00).

On top of the insider buying, it's good to see that HBL Power Systems insiders have a valuable investment in the business. To be specific, they have ₹1.8b worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 9.4% of the company; visible skin in the game.

Does HBL Power Systems Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about HBL Power Systems's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for HBL Power Systems that you should be aware of.

The good news is that HBL Power Systems is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HBL Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HBLENGINE

HBL Engineering

Manufactures and sells batteries and other products in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success