Investors Appear Satisfied With Harsha Engineers International Limited's (NSE:HARSHA) Prospects As Shares Rocket 26%

Harsha Engineers International Limited (NSE:HARSHA) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

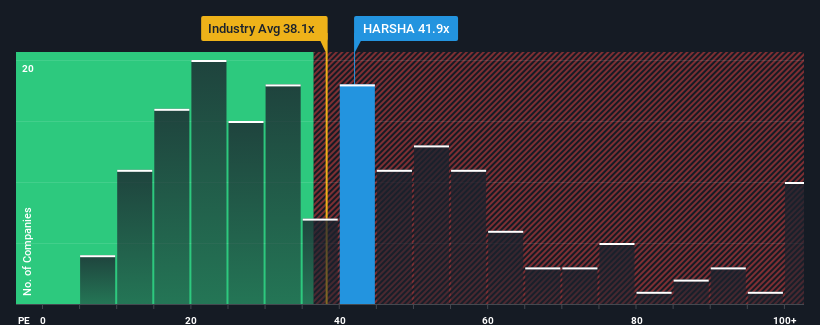

Following the firm bounce in price, Harsha Engineers International may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 41.9x, since almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Harsha Engineers International's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Harsha Engineers International

Is There Enough Growth For Harsha Engineers International?

There's an inherent assumption that a company should outperform the market for P/E ratios like Harsha Engineers International's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. Even so, admirably EPS has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 21% each year, which is noticeably less attractive.

In light of this, it's understandable that Harsha Engineers International's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Harsha Engineers International's P/E

Harsha Engineers International's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Harsha Engineers International maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Harsha Engineers International with six simple checks.

You might be able to find a better investment than Harsha Engineers International. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Harsha Engineers International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HARSHA

Harsha Engineers International

Engages in the manufacture and sale of precision bearing cages and high precision engineered components in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives