Should Income Investors Look At GMM Pfaudler Limited (NSE:GMMPFAUDLR) Before Its Ex-Dividend?

It looks like GMM Pfaudler Limited (NSE:GMMPFAUDLR) is about to go ex-dividend in the next three days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase GMM Pfaudler's shares on or after the 25th of July will not receive the dividend, which will be paid on the 28th of August.

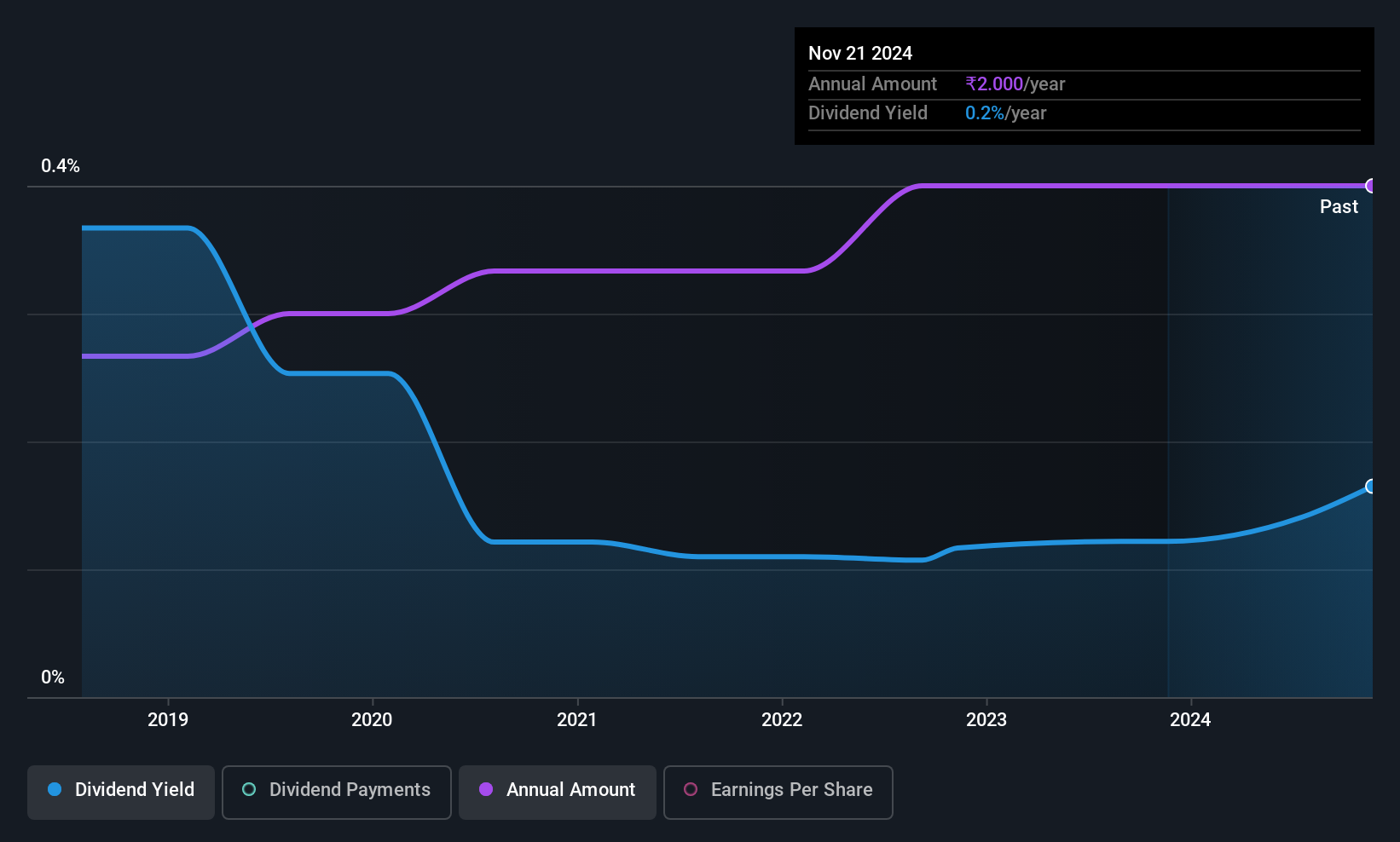

The company's next dividend payment will be ₹1.00 per share, on the back of last year when the company paid a total of ₹2.00 to shareholders. Based on the last year's worth of payments, GMM Pfaudler has a trailing yield of 0.2% on the current stock price of ₹1315.20. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. GMM Pfaudler paid out just 17% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether GMM Pfaudler generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 2.8% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for GMM Pfaudler

Click here to see how much of its profit GMM Pfaudler paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. GMM Pfaudler's earnings per share have fallen at approximately 6.2% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, GMM Pfaudler has increased its dividend at approximately 5.2% a year on average.

Final Takeaway

Should investors buy GMM Pfaudler for the upcoming dividend? GMM Pfaudler has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. All things considered, we are not particularly enthused about GMM Pfaudler from a dividend perspective.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Case in point: We've spotted 2 warning signs for GMM Pfaudler you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GMMPFAUDLR

GMM Pfaudler

Designs, manufactures, installs, and services corrosion-resistant equipment and complete chemical process systems used in the chemical, pharmaceutical, and other industries in India and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion