- India

- /

- Industrials

- /

- NSEI:GILLANDERS

These 4 Measures Indicate That Gillanders Arbuthnot (NSE:GILLANDERS) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Gillanders Arbuthnot and Company Limited (NSE:GILLANDERS) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out the opportunities and risks within the IN Industrials industry.

What Is Gillanders Arbuthnot's Net Debt?

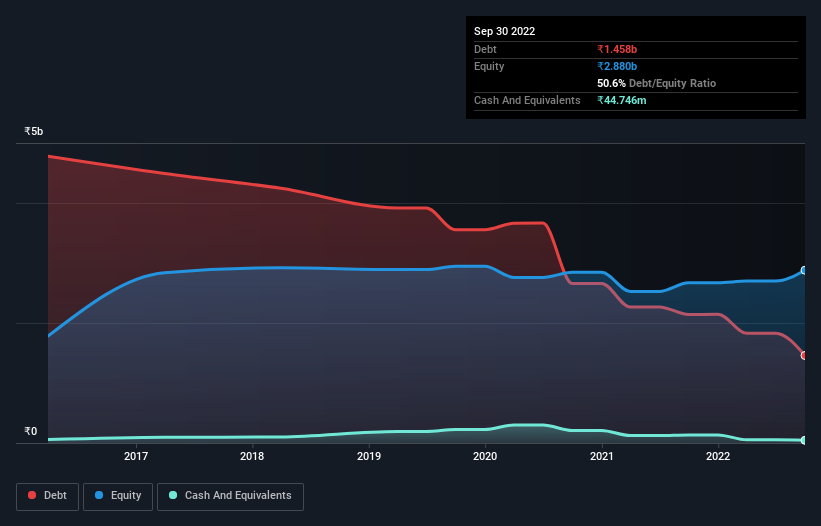

The image below, which you can click on for greater detail, shows that Gillanders Arbuthnot had debt of ₹1.46b at the end of September 2022, a reduction from ₹2.14b over a year. However, it does have ₹44.7m in cash offsetting this, leading to net debt of about ₹1.41b.

A Look At Gillanders Arbuthnot's Liabilities

According to the last reported balance sheet, Gillanders Arbuthnot had liabilities of ₹2.38b due within 12 months, and liabilities of ₹436.8m due beyond 12 months. Offsetting these obligations, it had cash of ₹44.7m as well as receivables valued at ₹468.1m due within 12 months. So it has liabilities totalling ₹2.31b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of ₹1.71b, we think shareholders really should watch Gillanders Arbuthnot's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Gillanders Arbuthnot's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 2.9 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Pleasingly, Gillanders Arbuthnot is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 379% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Gillanders Arbuthnot's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Gillanders Arbuthnot actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Gillanders Arbuthnot's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. But truth be told its level of total liabilities had us nibbling our nails. When we consider all the factors mentioned above, we do feel a bit cautious about Gillanders Arbuthnot's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Gillanders Arbuthnot (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GILLANDERS

Gillanders Arbuthnot

Engages in the textile, engineering, tea, and property businesses in India and internationally.

Low risk with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion