Elgi Rubber Company Limited (NSE:ELGIRUBCO) Soars 30% But It's A Story Of Risk Vs Reward

Elgi Rubber Company Limited (NSE:ELGIRUBCO) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 75% in the last year.

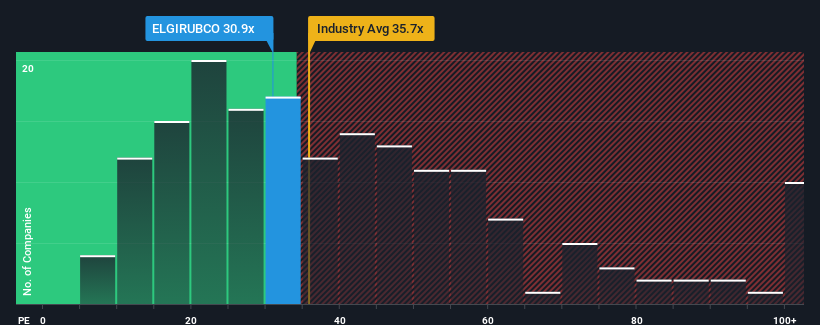

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Elgi Rubber's P/E ratio of 30.9x, since the median price-to-earnings (or "P/E") ratio in India is also close to 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Elgi Rubber as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Elgi Rubber

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Elgi Rubber's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 73% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 981% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Elgi Rubber is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Elgi Rubber's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Elgi Rubber currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Elgi Rubber (2 don't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Elgi Rubber, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Elgi Rubber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ELGIRUBCO

Elgi Rubber

Manufactures and sells reclaimed rubber, retreading machinery, and retread rubber in India and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives