- India

- /

- Construction

- /

- NSEI:EIEL

Market Might Still Lack Some Conviction On Enviro Infra Engineers Limited (NSE:EIEL) Even After 28% Share Price Boost

The Enviro Infra Engineers Limited (NSE:EIEL) share price has done very well over the last month, posting an excellent gain of 28%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

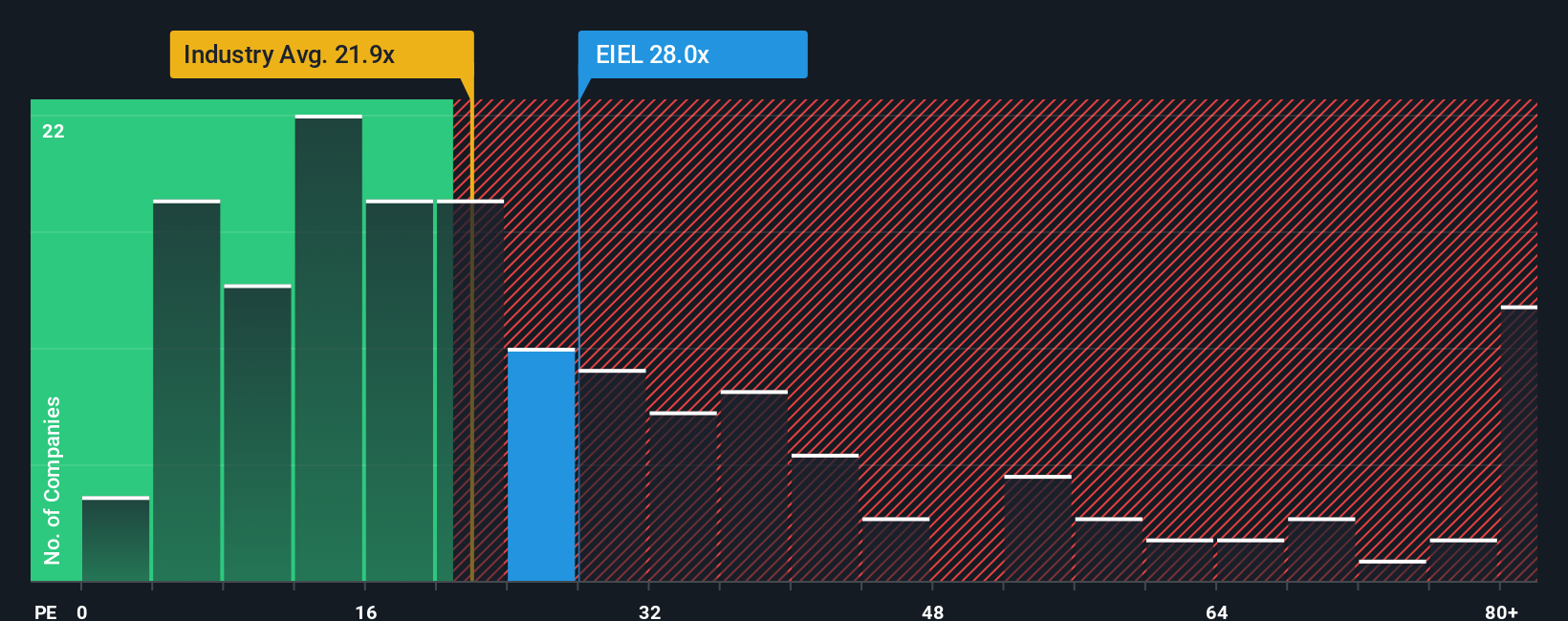

Although its price has surged higher, there still wouldn't be many who think Enviro Infra Engineers' price-to-earnings (or "P/E") ratio of 28x is worth a mention when the median P/E in India is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Enviro Infra Engineers as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Enviro Infra Engineers

How Is Enviro Infra Engineers' Growth Trending?

Enviro Infra Engineers' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. The strong recent performance means it was also able to grow EPS by 272% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Enviro Infra Engineers' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Enviro Infra Engineers' P/E?

Its shares have lifted substantially and now Enviro Infra Engineers' P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Enviro Infra Engineers currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You need to take note of risks, for example - Enviro Infra Engineers has 2 warning signs (and 1 which is concerning) we think you should know about.

You might be able to find a better investment than Enviro Infra Engineers. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Enviro Infra Engineers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EIEL

Enviro Infra Engineers

Engages in the design, construction, operation, and maintenance of water and wastewater treatment plants (WWTPs) and water supply scheme projects (WSSPs) for government authorities and bodies in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives