Stock Analysis

- India

- /

- Healthcare Services

- /

- NSEI:KRSNAA

Three Indian Exchange Growth Companies With Insider Ownership As High As 31%

Reviewed by Simply Wall St

The Indian market has shown robust growth, climbing 2.7% in the last week and an impressive 45% over the past year, with earnings projected to grow by 16% annually. In this thriving environment, stocks of growth companies with high insider ownership often signal strong confidence from those most familiar with the company's prospects and operations.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

We'll examine a selection from our screener results.

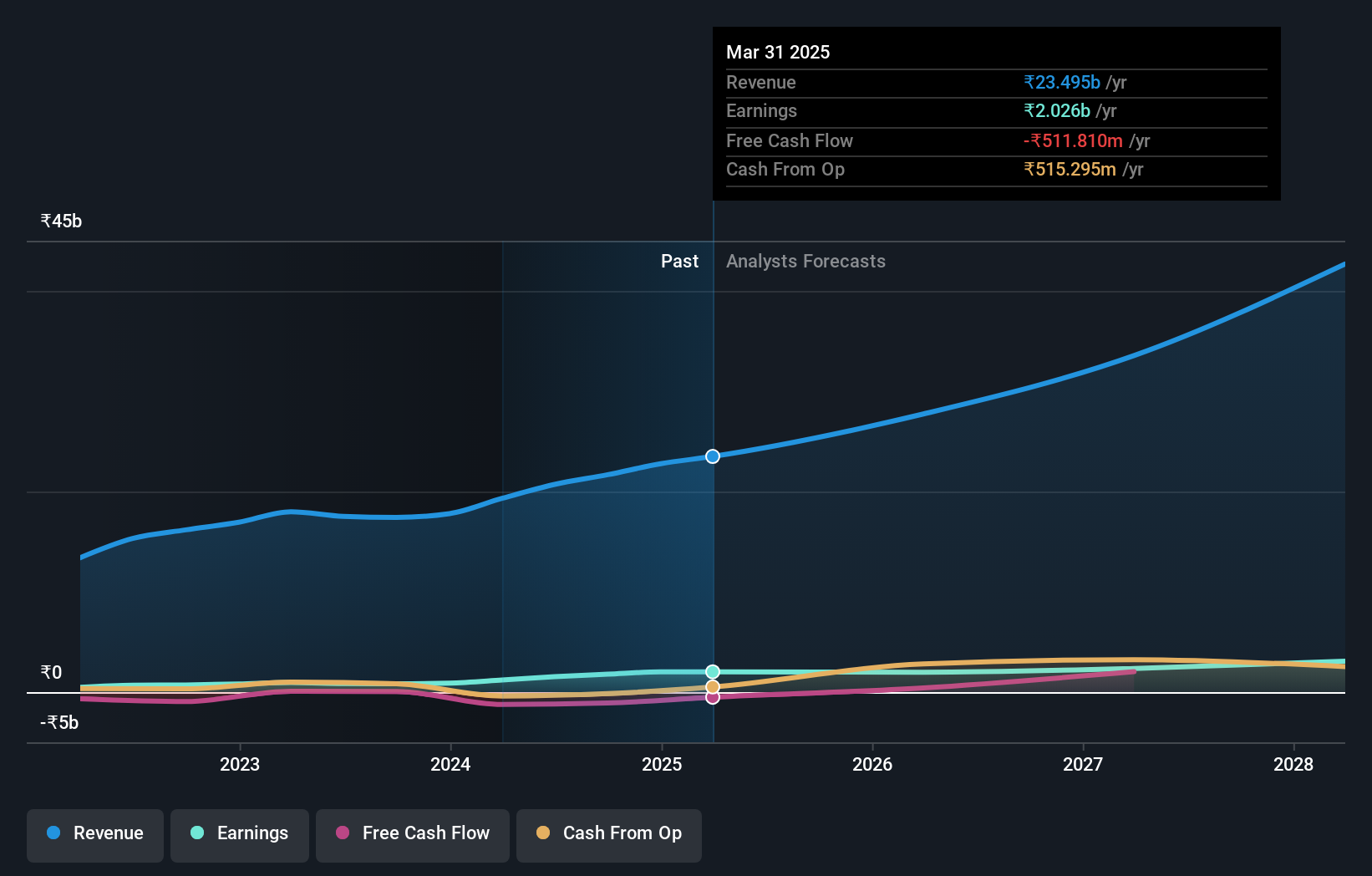

Capacit'e Infraprojects (NSEI:CAPACITE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capacit'e Infraprojects Limited operates in India, focusing on engineering, procurement, and construction services with a market capitalization of approximately ₹27.81 billion.

Operations: The company generates its revenue primarily from engineering, procurement, and construction contracts, totaling ₹19.32 billion.

Insider Ownership: 31.4%

Capacit'e Infraprojects, an Indian construction company, showcases robust growth prospects with its earnings forecasted to expand by 24.4% annually, outpacing the broader Indian market's 16% growth expectation. Despite past shareholder dilution, the firm maintains a competitive edge with a lower price-to-earnings ratio of 23.1x compared to the market average of 32.3x. Recent strategic moves include securing INR 1 billion through non-convertible debentures and leadership adjustments poised to bolster operational expertise and governance.

- Navigate through the intricacies of Capacit'e Infraprojects with our comprehensive analyst estimates report here.

- Our valuation report here indicates Capacit'e Infraprojects may be undervalued.

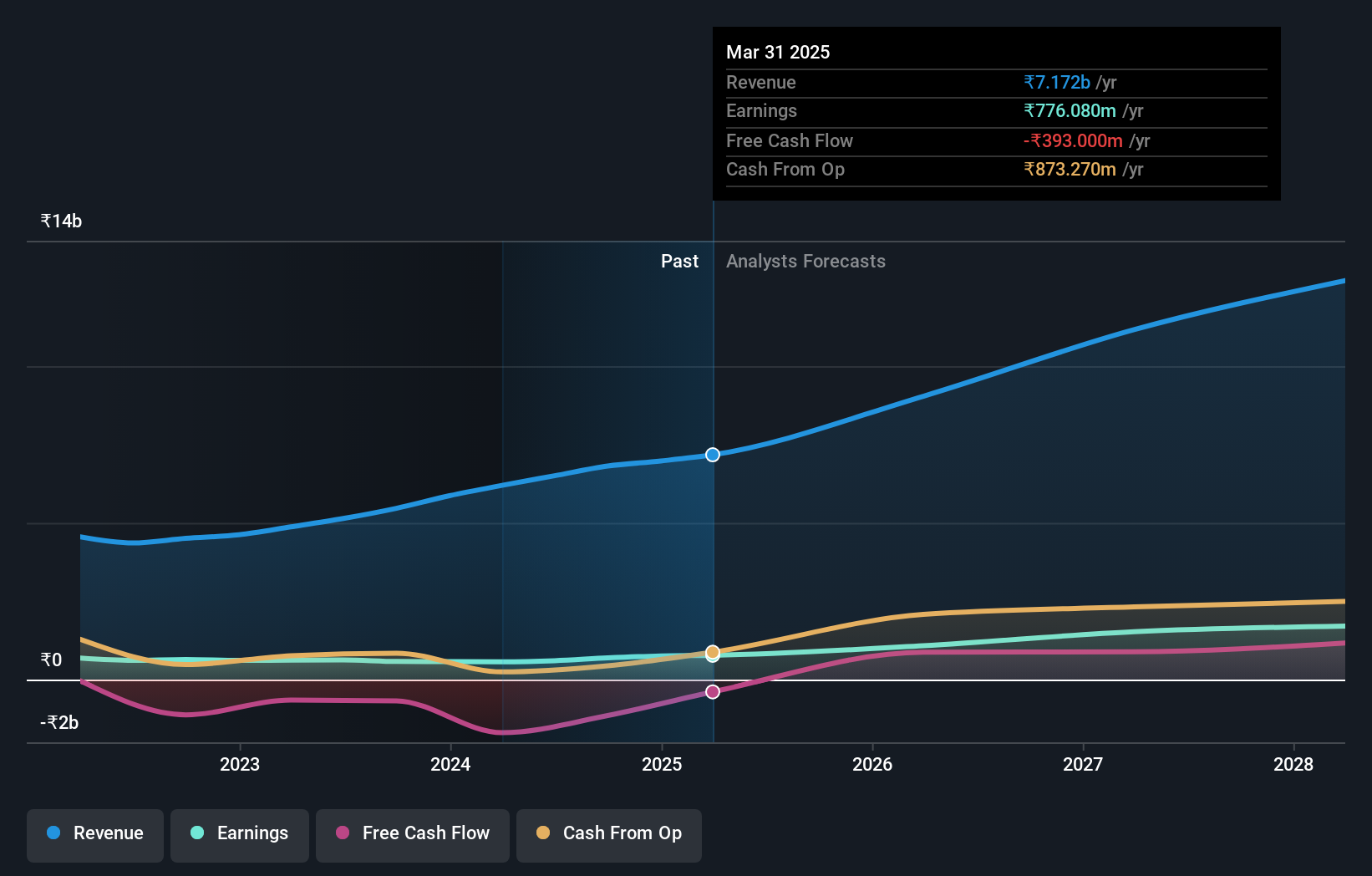

Krsnaa Diagnostics (NSEI:KRSNAA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krsnaa Diagnostics Limited operates in the healthcare sector, offering diagnostic services with a market capitalization of approximately ₹21.52 billion.

Operations: The company generates revenue primarily from radiology and pathology services, totaling approximately ₹6.20 billion.

Insider Ownership: 27.3%

Krsnaa Diagnostics, an Indian healthcare firm, is set to outperform with a projected annual revenue growth of 26.2% and earnings increase of 37.8%. Despite a dividend that's not well supported by cash flow and recent shareholder dilution, its price-to-earnings ratio at ₹37.9 is attractive compared to the industry average of ₹45.9. The appointment of Mitesh Dave as CEO promises fresh strategic direction, leveraging his extensive experience across several sectors to potentially enhance company performance and stakeholder value.

- Dive into the specifics of Krsnaa Diagnostics here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Krsnaa Diagnostics is trading behind its estimated value.

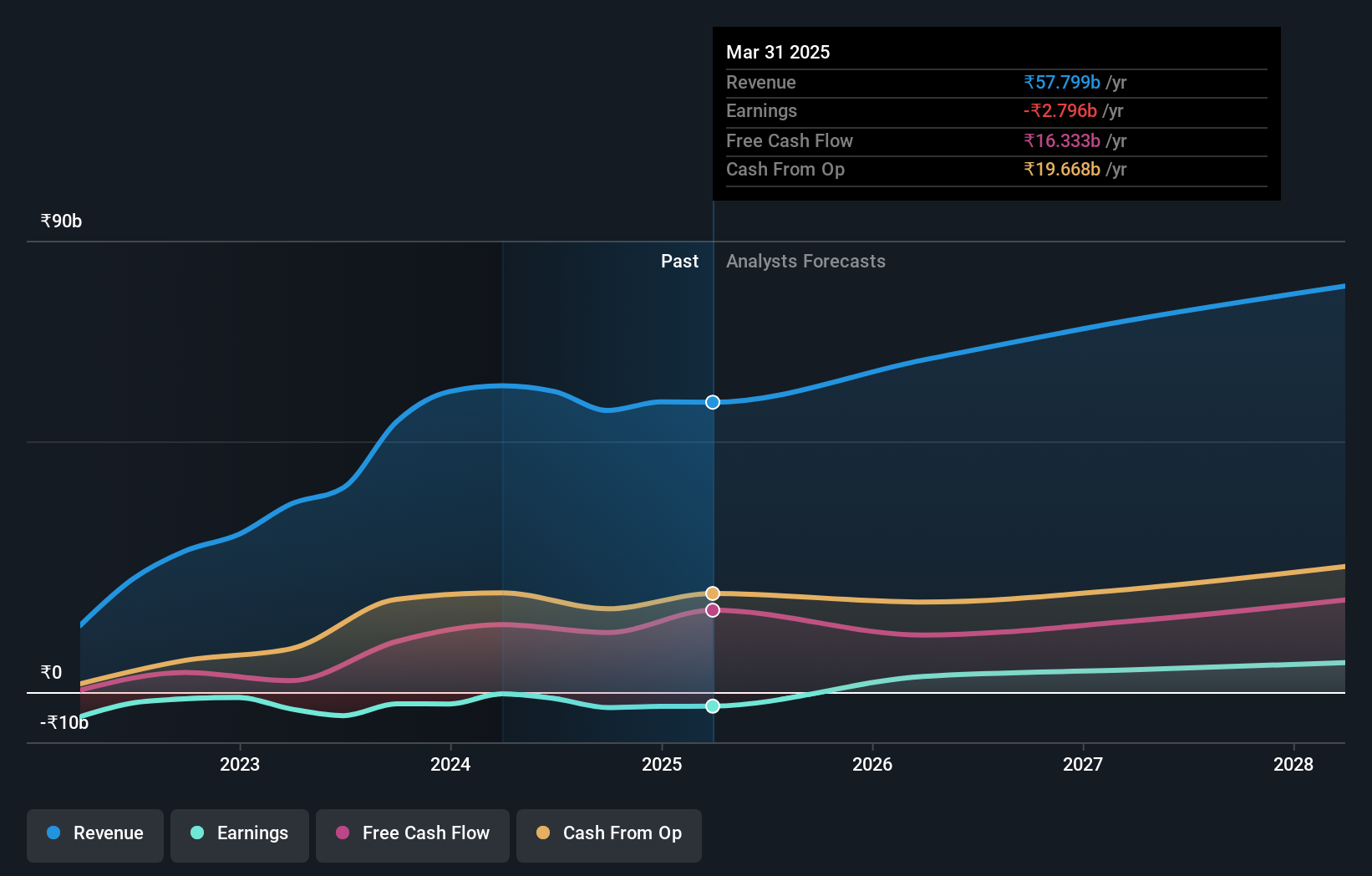

PVR INOX (NSEI:PVRINOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited operates as a theatrical exhibition company, involved in the exhibition, distribution, and production of movies in India and Sri Lanka, with a market capitalization of approximately ₹136.42 billion.

Operations: The company generates revenue primarily through movie exhibition, which accounts for ₹60.71 billion, and other activities including movie production and distribution, contributing ₹3.17 billion.

Insider Ownership: 11.6%

PVR INOX, India's premier cinema exhibitor, is trading at 37.1% below its estimated fair value and is expected to become profitable within three years, signaling potential growth above the market average. However, its forecasted annual revenue growth of 11.3% lags behind the desired 20% benchmark for high-growth companies. Despite this slower pace, it exceeds the Indian market's average growth rate of 9.6%. Recent expansions include launching multiplexes in Andhra Pradesh and Rajasthan, enhancing its luxury cinema offerings and technological capabilities which could bolster future profitability despite current underperformance in return on equity projections (9.8%).

- Click here and access our complete growth analysis report to understand the dynamics of PVR INOX.

- The valuation report we've compiled suggests that PVR INOX's current price could be quite moderate.

Make It Happen

- Embark on your investment journey to our 81 Fast Growing Indian Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Krsnaa Diagnostics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRSNAA

Flawless balance sheet with high growth potential.