- India

- /

- Electrical

- /

- NSEI:BHEL

Do Its Financials Have Any Role To Play In Driving Bharat Heavy Electricals Limited's (NSE:BHEL) Stock Up Recently?

Most readers would already be aware that Bharat Heavy Electricals' (NSE:BHEL) stock increased significantly by 9.2% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Bharat Heavy Electricals' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bharat Heavy Electricals is:

1.2% = ₹2.9b ÷ ₹247b (Based on the trailing twelve months to June 2025).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.01 in profit.

View our latest analysis for Bharat Heavy Electricals

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Bharat Heavy Electricals' Earnings Growth And 1.2% ROE

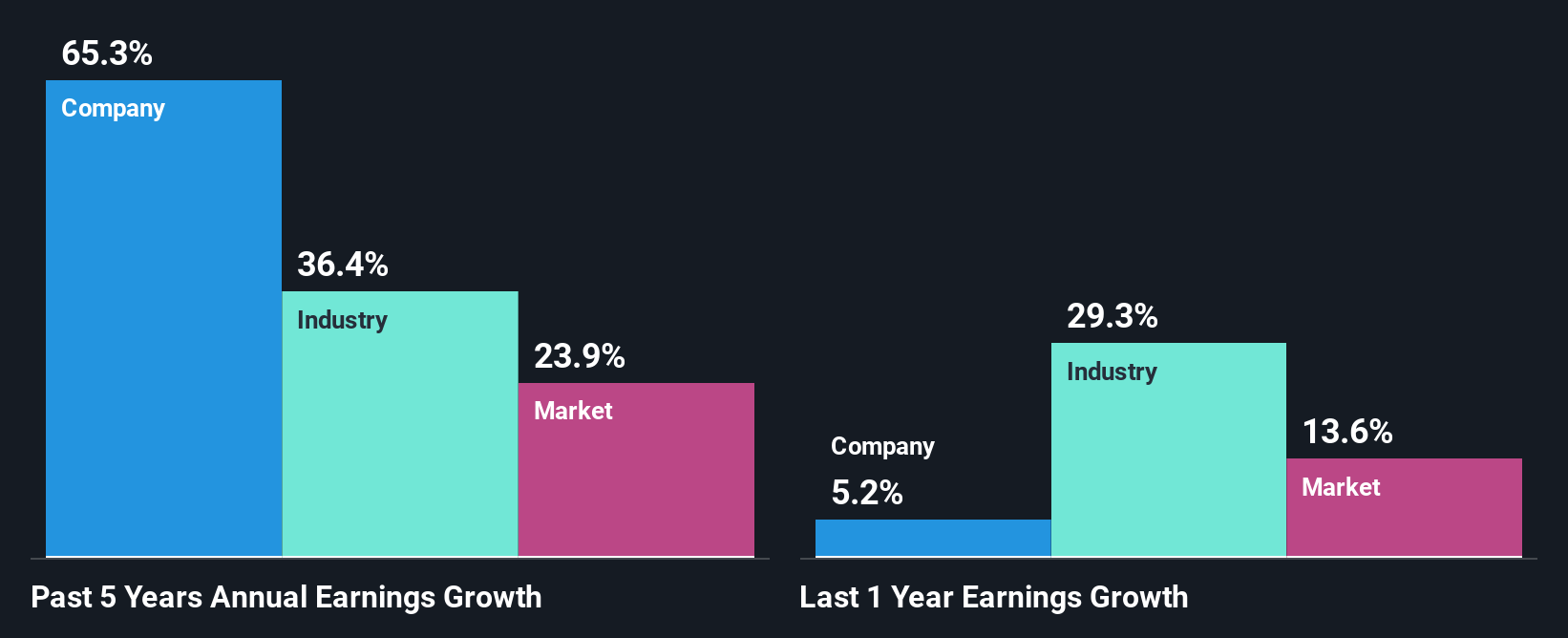

It is hard to argue that Bharat Heavy Electricals' ROE is much good in and of itself. Even when compared to the industry average of 13%, the ROE figure is pretty disappointing. However, we we're pleasantly surprised to see that Bharat Heavy Electricals grew its net income at a significant rate of 65% in the last five years. Therefore, there could be other reasons behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Bharat Heavy Electricals' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 36% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Bharat Heavy Electricals''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Bharat Heavy Electricals Efficiently Re-investing Its Profits?

The three-year median payout ratio for Bharat Heavy Electricals is 31%, which is moderately low. The company is retaining the remaining 69%. So it seems that Bharat Heavy Electricals is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Additionally, Bharat Heavy Electricals has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 22% over the next three years. The fact that the company's ROE is expected to rise to 12% over the same period is explained by the drop in the payout ratio.

Summary

Overall, we feel that Bharat Heavy Electricals certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Heavy Electricals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHEL

Bharat Heavy Electricals

Operates as power plant equipment manufacturer in India and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success