- India

- /

- Electrical

- /

- NSEI:BHEL

Bharat Heavy Electricals Limited (NSE:BHEL) Screens Well But There Might Be A Catch

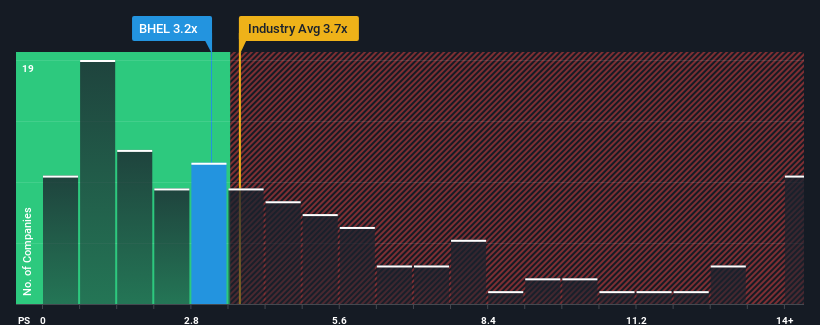

It's not a stretch to say that Bharat Heavy Electricals Limited's (NSE:BHEL) price-to-sales (or "P/S") ratio of 3.2x right now seems quite "middle-of-the-road" for companies in the Electrical industry in India, where the median P/S ratio is around 3.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Bharat Heavy Electricals

How Bharat Heavy Electricals Has Been Performing

With revenue growth that's inferior to most other companies of late, Bharat Heavy Electricals has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bharat Heavy Electricals.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bharat Heavy Electricals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.4%. The latest three year period has also seen an excellent 32% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 27% each year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 18% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Bharat Heavy Electricals' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Bharat Heavy Electricals' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bharat Heavy Electricals currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Bharat Heavy Electricals with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Heavy Electricals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHEL

Bharat Heavy Electricals

Operates as engineering and manufacturing company in India and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives