There's A Lot To Like About BEML's (NSE:BEML) Upcoming ₹15.50 Dividend

BEML Limited (NSE:BEML) stock is about to trade ex-dividend in three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase BEML's shares on or after the 13th of September, you won't be eligible to receive the dividend, when it is paid on the 20th of October.

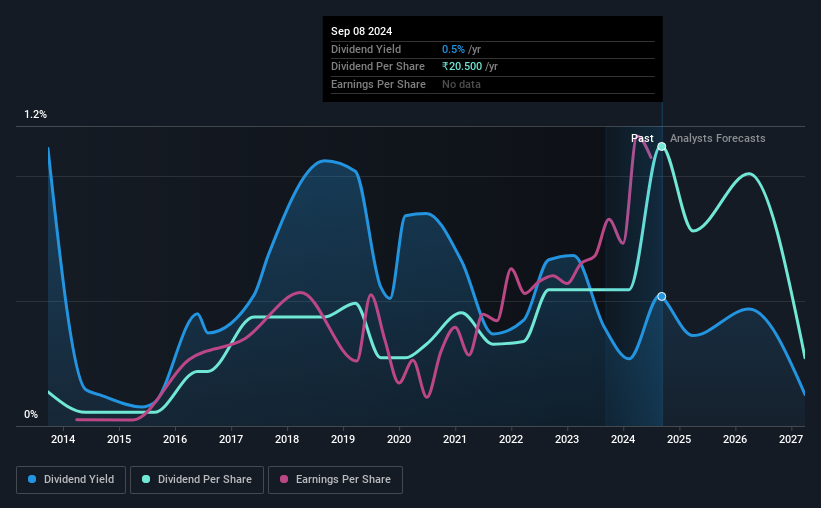

The company's upcoming dividend is ₹15.50 a share, following on from the last 12 months, when the company distributed a total of ₹20.50 per share to shareholders. Calculating the last year's worth of payments shows that BEML has a trailing yield of 0.5% on the current share price of ₹3956.75. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether BEML can afford its dividend, and if the dividend could grow.

See our latest analysis for BEML

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see BEML paying out a modest 30% of its earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 12% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that BEML's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see BEML has grown its earnings rapidly, up 35% a year for the past five years. BEML is paying out less than half its earnings and cash flow, while simultaneously growing earnings per share at a rapid clip. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, BEML has lifted its dividend by approximately 23% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

Is BEML worth buying for its dividend? BEML has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

In light of that, while BEML has an appealing dividend, it's worth knowing the risks involved with this stock. For example - BEML has 2 warning signs we think you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if BEML might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BEML

BEML

Provides products and services to the mining and construction, rail and metro, power, and defense and aerospace sectors in India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026