- India

- /

- Aerospace & Defense

- /

- NSEI:BDL

Bharat Dynamics Limited (NSE:BDL) Stocks Shoot Up 57% But Its P/S Still Looks Reasonable

Bharat Dynamics Limited (NSE:BDL) shares have continued their recent momentum with a 57% gain in the last month alone. The annual gain comes to 179% following the latest surge, making investors sit up and take notice.

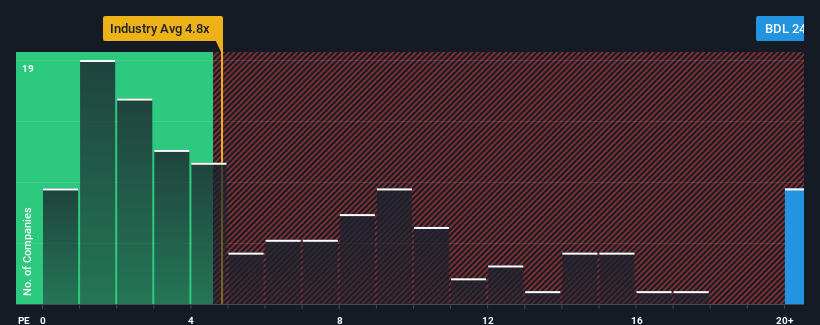

After such a large jump in price, given around half the companies in India's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 9.9x, you may consider Bharat Dynamics as a stock to avoid entirely with its 24.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bharat Dynamics

How Has Bharat Dynamics Performed Recently?

Bharat Dynamics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Bharat Dynamics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Bharat Dynamics?

In order to justify its P/S ratio, Bharat Dynamics would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. Regardless, revenue has managed to lift by a handy 5.0% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 39% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 18% per annum, which is noticeably less attractive.

In light of this, it's understandable that Bharat Dynamics' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Bharat Dynamics' P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bharat Dynamics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Bharat Dynamics that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bharat Dynamics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BDL

Bharat Dynamics

Manufactures and sells guided missiles, underwater weapons, air-borne products, and allied defense equipment in India.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives