Shareholders Shouldn’t Be Too Comfortable With Balu Forge Industries' (NSE:BALUFORGE) Strong Earnings

Despite posting strong earnings, Balu Forge Industries Limited's (NSE:BALUFORGE) stock didn't move much over the last week. We think that investors might be worried about the foundations the earnings are built on.

Zooming In On Balu Forge Industries' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

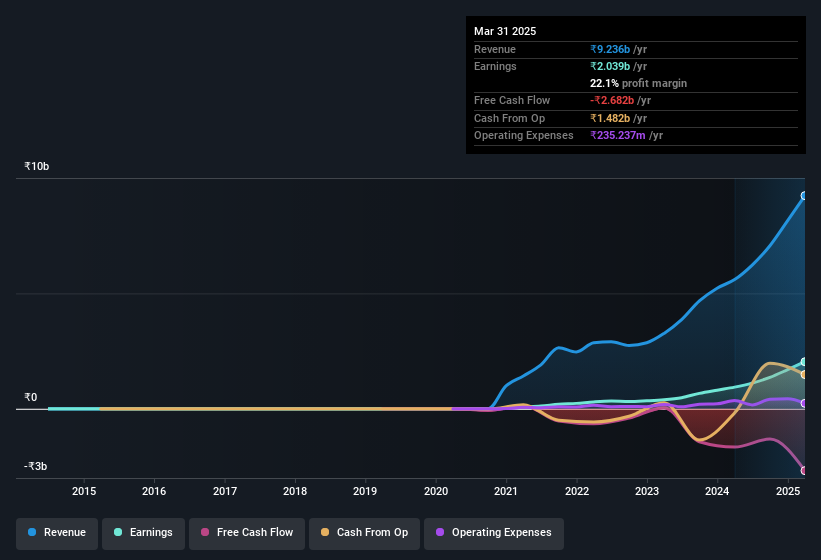

Over the twelve months to March 2025, Balu Forge Industries recorded an accrual ratio of 0.63. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of ₹2.7b, in contrast to the aforementioned profit of ₹2.04b. We also note that Balu Forge Industries' free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₹2.7b. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Balu Forge Industries.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Balu Forge Industries expanded the number of shares on issue by 9.3% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Balu Forge Industries' EPS by clicking here.

A Look At The Impact Of Balu Forge Industries' Dilution On Its Earnings Per Share (EPS)

Balu Forge Industries has improved its profit over the last three years, with an annualized gain of 583% in that time. In comparison, earnings per share only gained 379% over the same period. And the 118% profit boost in the last year certainly seems impressive at first glance. But in comparison, EPS only increased by 96% over the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So Balu Forge Industries shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Balu Forge Industries' Profit Performance

In conclusion, Balu Forge Industries has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means its earnings per share growth is weaker than its profit growth. For the reasons mentioned above, we think that a perfunctory glance at Balu Forge Industries' statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing Balu Forge Industries at this point in time. You'd be interested to know, that we found 2 warning signs for Balu Forge Industries and you'll want to know about them.

Our examination of Balu Forge Industries has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Balu Forge Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BALUFORGE

Balu Forge Industries

Manufactures and sells crankshafts in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success