Stock Analysis

Indian Exchange Highlights Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, surging 46% over the past year with earnings projected to increase by 16% annually. In this thriving environment, companies with high insider ownership often signal strong confidence in future prospects, making them particularly compelling in the current market conditions.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Chalet Hotels (NSEI:CHALET) | 13.1% | 27.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

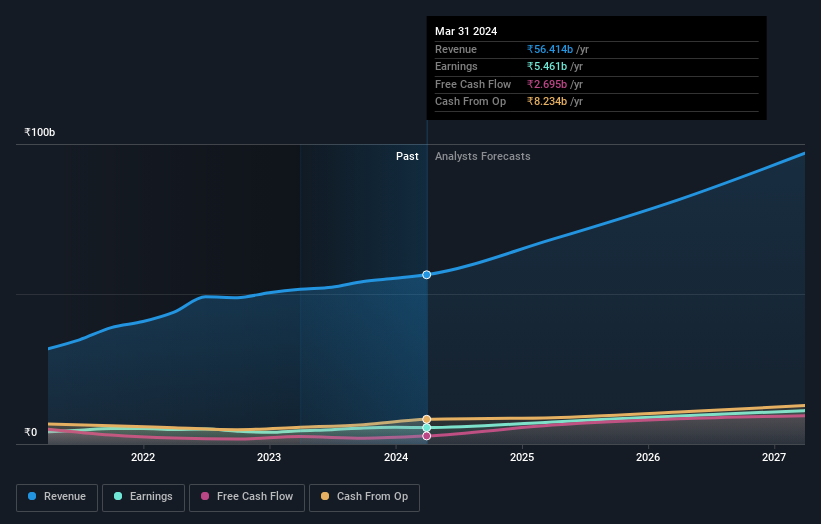

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, adhesives, and sealants both in India and internationally, with a market capitalization of approximately ₹610.76 billion.

Operations: The company generates revenue primarily from two segments: plumbing (₹41.42 billion) and paints and adhesives (₹14.99 billion).

Insider Ownership: 39.4%

Astral Limited, a key player in the Indian market, showcases strong insider ownership coupled with robust growth metrics. Despite not having substantial insider transactions recently, its financial health is evident with consistent earnings growth of 23% per year anticipated over the next three years, outpacing the Indian market's average. The company's Return on Equity is expected to remain high at 22.7%. However, revenue growth projections are modest at 17.4% annually, slightly lagging behind more aggressive growth benchmarks but still ahead of broader market trends.

- Click to explore a detailed breakdown of our findings in Astral's earnings growth report.

- According our valuation report, there's an indication that Astral's share price might be on the expensive side.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

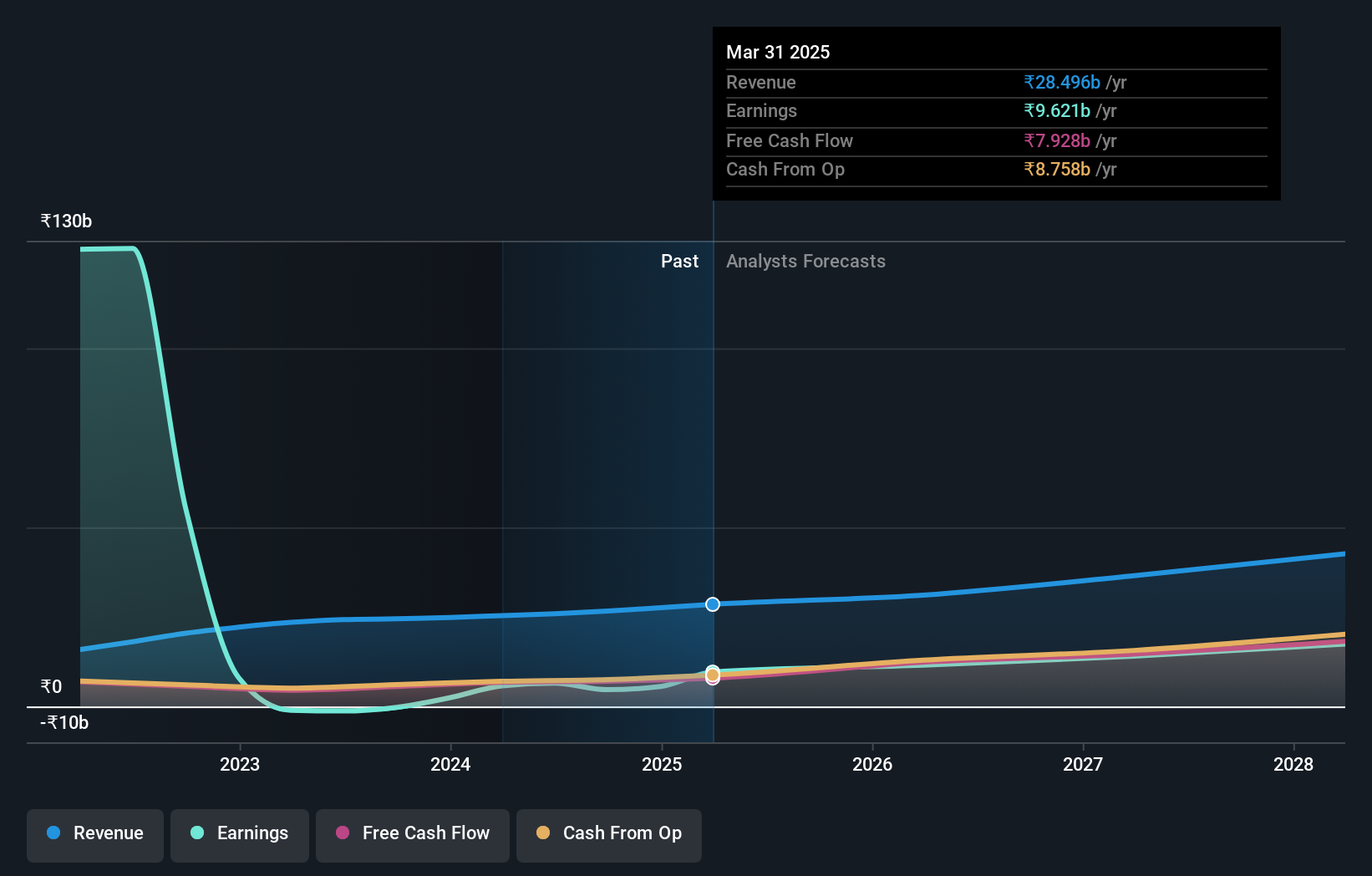

Overview: Info Edge (India) Limited is an online classifieds company engaged in recruitment, matrimony, real estate, and education services both in India and globally, with a market capitalization of approximately ₹823.70 billion.

Operations: The company generates revenue primarily through recruitment solutions (₹18.80 billion) and real estate classifieds (₹3.51 billion).

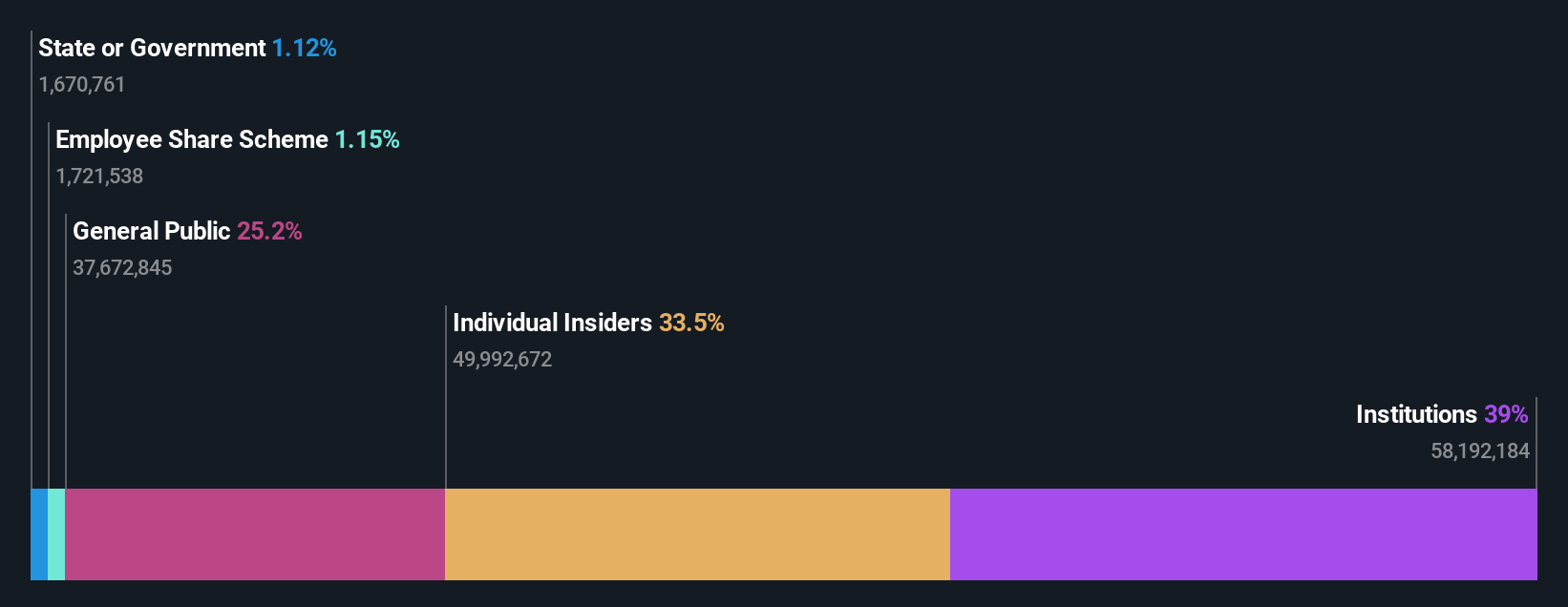

Insider Ownership: 37.9%

Info Edge (India) Limited, while demonstrating a significant turnaround to profitability this year, has shown robust earnings growth and a promising future outlook. With insider buying activities outpacing sales in recent months, it reflects strong confidence from insiders. However, the company's revenue growth is expected to be moderate and its Return on Equity is projected to remain low at 5.9% in three years. Despite these challenges, Info Edge continues to engage actively in significant industry conferences, underscoring its strategic intent to maintain visibility and growth in a competitive market.

- Delve into the full analysis future growth report here for a deeper understanding of Info Edge (India).

- Upon reviewing our latest valuation report, Info Edge (India)'s share price might be too optimistic.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited operates in the software industry, offering products, services, and technology solutions across India, North America, and other global markets, with a market capitalization of approximately ₹579.44 billion.

Operations: The company generates revenue from three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

Insider Ownership: 34.3%

Persistent Systems has demonstrated robust growth with a 13.3% annual increase in revenue, outpacing the Indian market's average of 9.6%. Despite recent executive changes and the resignation of key personnel like Ms. Merlyn Mathew, the company continues to innovate, as seen with the launch of GenAI Hub. This platform is set to enhance enterprise AI application development significantly. However, while earnings are expected to grow by 18.2% annually—higher than the market average—this figure does not reach the high growth benchmark of over 20%.

- Take a closer look at Persistent Systems' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Persistent Systems' current price could be inflated.

Where To Now?

- Click through to start exploring the rest of the 80 Fast Growing Indian Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Astral is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ASTRAL

Astral

Manufactures and markets pipes, water tanks, and adhesives and sealants in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.