- India

- /

- Electronic Equipment and Components

- /

- NSEI:REDINGTON

Top 3 Indian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The Indian market has gained 1.8%, and in the last year, it has climbed 41% with earnings forecasted to grow by 17% annually. In such a robust environment, selecting dividend stocks that offer consistent returns can be a strategic way to enhance your portfolio.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.14% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.83% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.04% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.21% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.21% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.21% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.08% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.05% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.25% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.17% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top Indian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

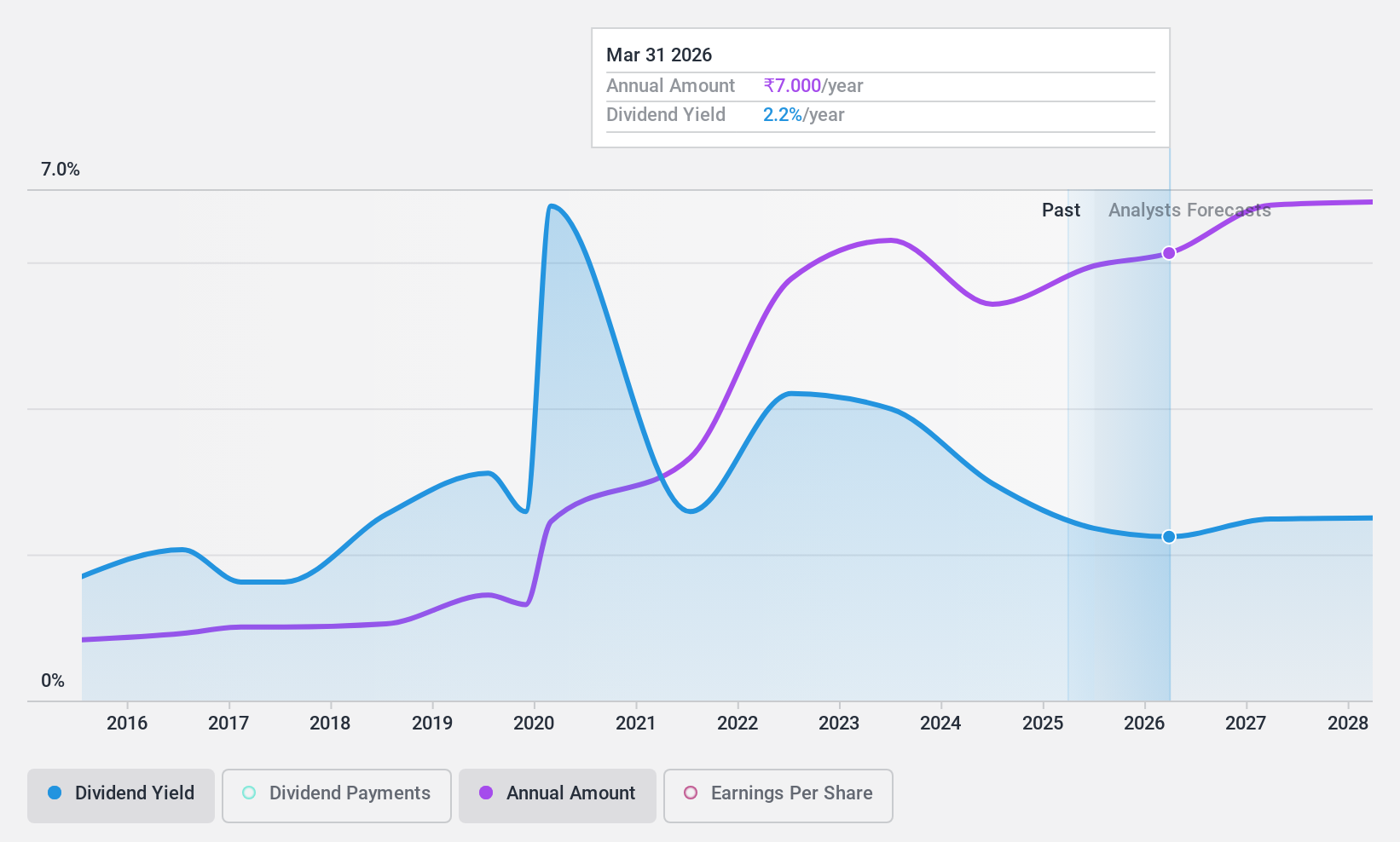

Canara Bank (NSEI:CANBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canara Bank offers a range of banking products and services both in India and internationally, with a market cap of ₹957.32 billion.

Operations: Canara Bank's revenue segments include Treasury Operations (₹255.75 billion), Life Insurance Operation (₹120.19 billion), Wholesale Banking Operations (₹430.48 billion), Retail Banking Operations - Digital Banking (₹22.30 million), and Other Retail Banking Operations (₹632.28 billion).

Dividend Yield: 3.1%

Canara Bank's dividend payments have been volatile over the past decade, though they are currently well-covered by earnings with a low payout ratio of 19.1%. The bank's recent $300 million fixed-income offering and executive changes indicate ongoing strategic adjustments. Despite trading at a significant discount to its estimated fair value, the high level of bad loans (4.3%) remains a concern for long-term sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Canara Bank.

- Our expertly prepared valuation report Canara Bank implies its share price may be lower than expected.

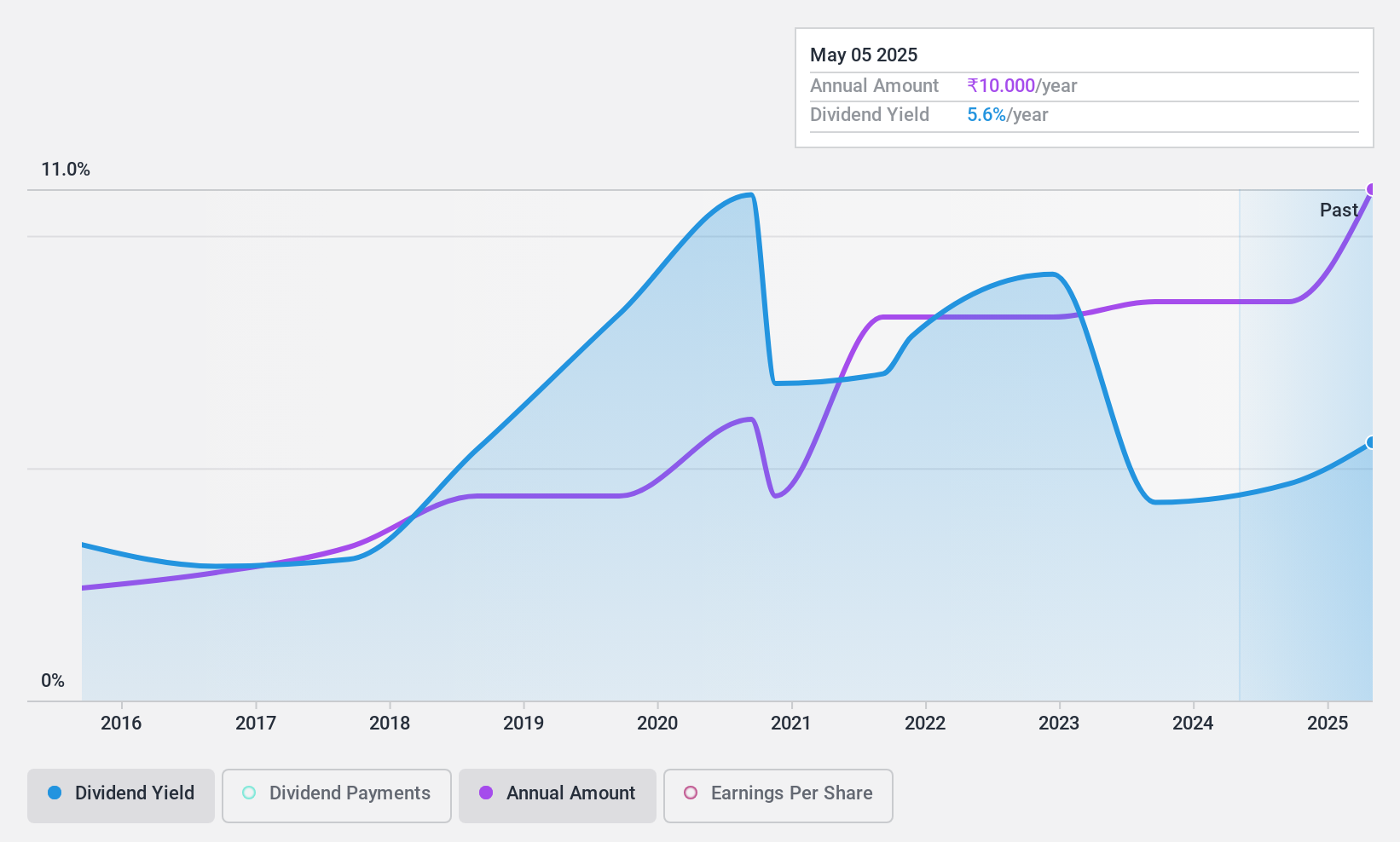

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹71.00 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh.

Operations: PTC India Limited generates revenue primarily from its power trading segment, which accounts for ₹159.67 billion, and its financing business, which contributes ₹7.35 billion.

Dividend Yield: 3.3%

PTC India recently declared a ₹7.80 cash dividend with an ex-div date of August 20, 2024. The company's Q1 2024 earnings showed a net income increase to ₹1.74 billion from ₹1.30 billion the previous year, indicating strong profitability. PTC's dividends are well-covered by both earnings (54% payout ratio) and cash flows (9.4% cash payout ratio), though they have been volatile over the past decade, impacting reliability for consistent dividend investors.

- Unlock comprehensive insights into our analysis of PTC India stock in this dividend report.

- The analysis detailed in our PTC India valuation report hints at an deflated share price compared to its estimated value.

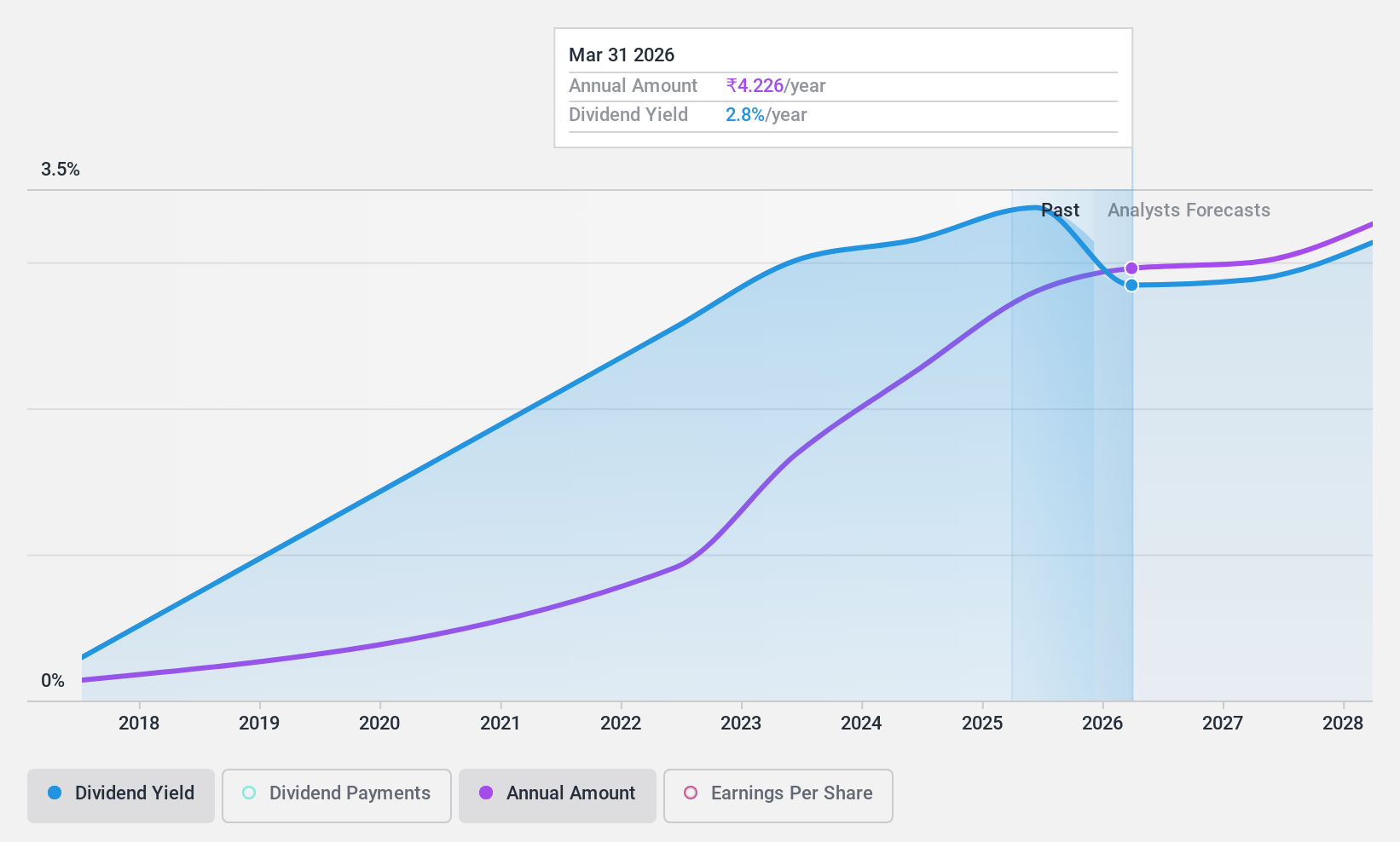

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited offers supply chain solutions both in India and internationally, with a market cap of ₹150.95 billion.

Operations: Redington Limited's revenue segments include IT products, which generated ₹492.20 billion, and mobility products, contributing ₹215.50 billion.

Dividend Yield: 3.2%

Redington's dividend payments are covered by earnings (39.8% payout ratio) and cash flows (50.6% cash payout ratio), but have been volatile over the past decade, affecting their reliability. Despite this, dividends have increased over the past 10 years. The stock trades at 9.6% below its estimated fair value and offers a dividend yield in the top 25% of Indian market payers. Recent Q1 earnings showed slight revenue growth to ₹213 billion with net income at ₹2.46 billion.

- Navigate through the intricacies of Redington with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Redington shares in the market.

Make It Happen

- Embark on your investment journey to our 17 Top Indian Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:REDINGTON

Redington

Distributes information technology, mobility, and other technology products in India, the Middle East, Turkey, Africa, and South Asian countries.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives