- India

- /

- Auto Components

- /

- NSEI:TALBROAUTO

We Think Some Shareholders May Hesitate To Increase Talbros Automotive Components Limited's (NSE:TALBROAUTO) CEO Compensation

Key Insights

- Talbros Automotive Components will host its Annual General Meeting on 25th of September

- Salary of ₹9.06m is part of CEO Umesh Talwar's total remuneration

- Total compensation is 135% above industry average

- Talbros Automotive Components' total shareholder return over the past three years was 815% while its EPS grew by 41% over the past three years

Performance at Talbros Automotive Components Limited (NSE:TALBROAUTO) has been reasonably good and CEO Umesh Talwar has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 25th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Talbros Automotive Components

Comparing Talbros Automotive Components Limited's CEO Compensation With The Industry

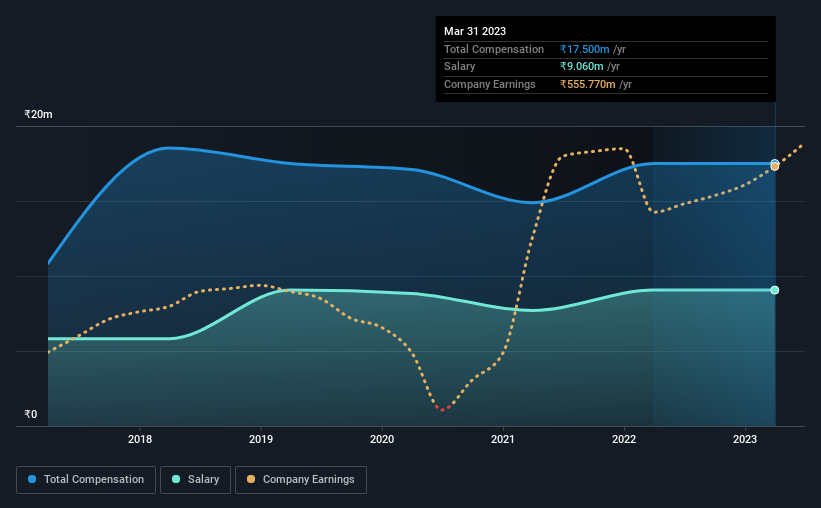

According to our data, Talbros Automotive Components Limited has a market capitalization of ₹12b, and paid its CEO total annual compensation worth ₹17m over the year to March 2023. This was the same as last year. In particular, the salary of ₹9.06m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Indian Auto Components industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹7.4m. Accordingly, our analysis reveals that Talbros Automotive Components Limited pays Umesh Talwar north of the industry median. Furthermore, Umesh Talwar directly owns ₹180m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹9.1m | ₹9.1m | 52% |

| Other | ₹8.4m | ₹8.4m | 48% |

| Total Compensation | ₹17m | ₹17m | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. In Talbros Automotive Components' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Talbros Automotive Components Limited's Growth Numbers

Talbros Automotive Components Limited's earnings per share (EPS) grew 41% per year over the last three years. It achieved revenue growth of 14% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Talbros Automotive Components Limited Been A Good Investment?

Boasting a total shareholder return of 815% over three years, Talbros Automotive Components Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Talbros Automotive Components.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Talbros Automotive Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TALBROAUTO

Talbros Automotive Components

Engages in the manufacture and sale of auto components in India.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives