- India

- /

- Auto Components

- /

- NSEI:PRICOLLTD

Pricol Limited (NSE:PRICOLLTD) Stocks Shoot Up 25% But Its P/E Still Looks Reasonable

Pricol Limited (NSE:PRICOLLTD) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 9.0% isn't as attractive.

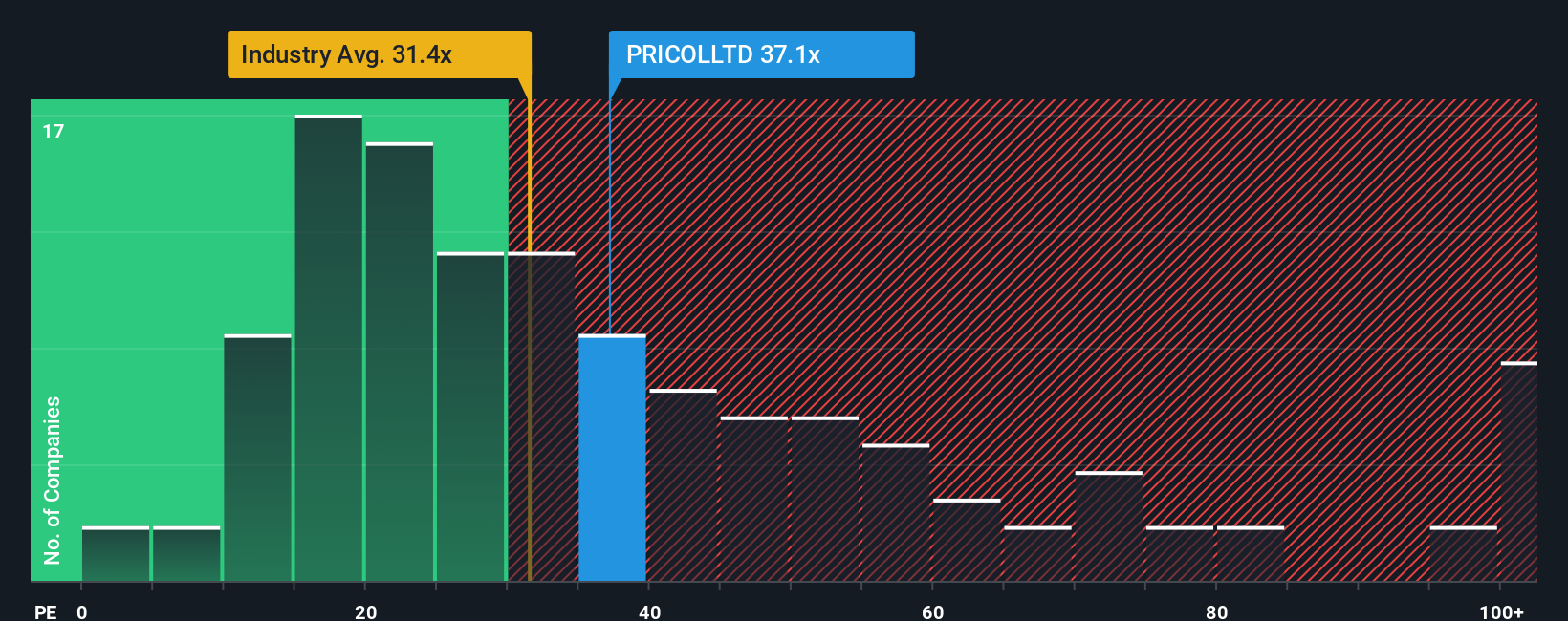

Since its price has surged higher, Pricol's price-to-earnings (or "P/E") ratio of 37.1x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 27x and even P/E's below 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Pricol as its earnings have been rising slower than most other companies. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Pricol

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Pricol's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 146% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 23% per annum during the coming three years according to the only analyst following the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

With this information, we can see why Pricol is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Pricol's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Pricol's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Pricol with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Pricol. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRICOLLTD

Pricol

Manufactures and sells instrument clusters and other allied automobile components to original equipment manufacturers and replacement markets in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives