- India

- /

- Auto Components

- /

- NSEI:PRICOLLTD

If EPS Growth Is Important To You, Pricol (NSE:PRICOLLTD) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Pricol (NSE:PRICOLLTD), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Pricol with the means to add long-term value to shareholders.

View our latest analysis for Pricol

How Fast Is Pricol Growing Its Earnings Per Share?

Over the last three years, Pricol has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Pricol's EPS grew from ₹3.26 to ₹9.19, over the previous 12 months. It's a rarity to see 182% year-on-year growth like that.

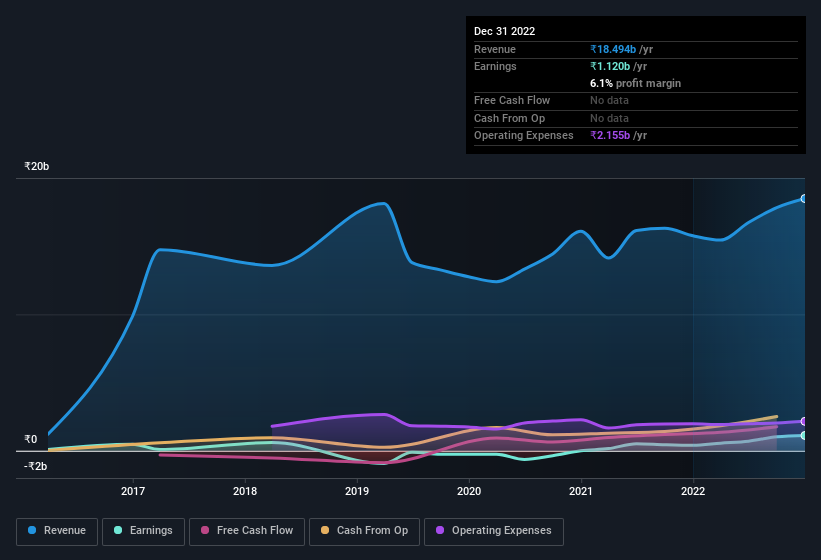

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Pricol's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Pricol maintained stable EBIT margins over the last year, all while growing revenue 17% to ₹18b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Pricol isn't a huge company, given its market capitalisation of ₹24b. That makes it extra important to check on its balance sheet strength.

Are Pricol Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Pricol insiders spent ₹1.3m on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

On top of the insider buying, it's good to see that Pricol insiders have a valuable investment in the business. Holding ₹6.2b worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That holding amounts to 26% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Pricol's CEO, P. Ganesh, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Pricol, with market caps between ₹8.2b and ₹33b, is around ₹18m.

Pricol's CEO only received compensation totalling ₹3.1m in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Pricol Worth Keeping An Eye On?

Pricol's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Pricol belongs near the top of your watchlist. Now, you could try to make up your mind on Pricol by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Pricol is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRICOLLTD

Pricol

Manufactures and sells instrument clusters and other allied automobile components to original equipment manufacturers and replacement markets in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives