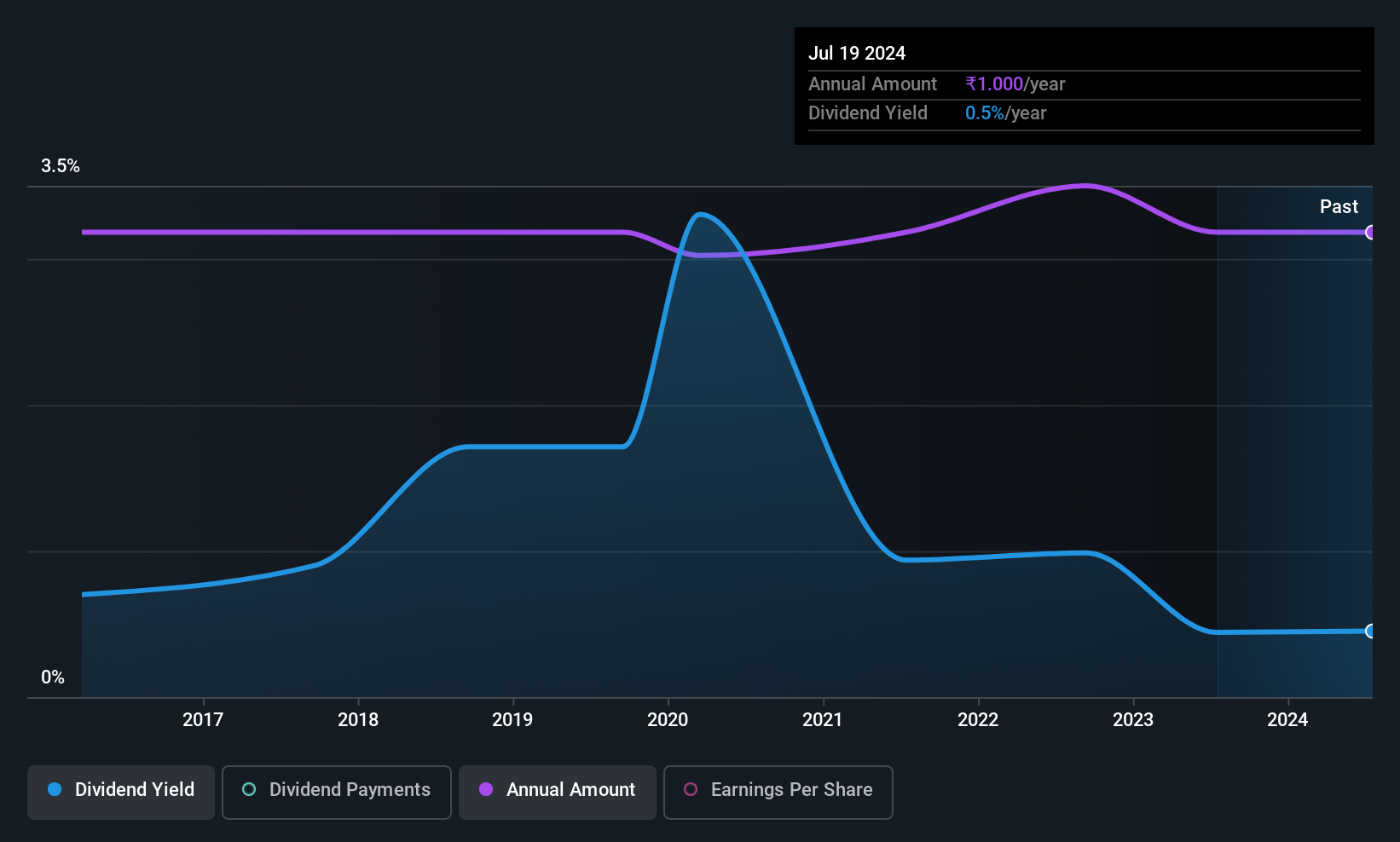

Precision Camshafts Limited's (NSE:PRECAM) investors are due to receive a payment of ₹1.00 per share on 29th of August. The dividend yield is 0.5% based on this payment, which is a little bit low compared to the other companies in the industry.

Precision Camshafts' Payment Could Potentially Have Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, Precision Camshafts' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 8.9% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 16% by next year, which we think can be pretty sustainable going forward.

Check out our latest analysis for Precision Camshafts

Precision Camshafts Is Still Building Its Track Record

Precision Camshafts' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The most recent annual payment of ₹1.00 is about the same as the annual payment 9 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Precision Camshafts Could Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. Precision Camshafts has seen EPS rising for the last five years, at 8.9% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Precision Camshafts Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Precision Camshafts that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRECAM

Precision Camshafts

Engages in the manufacture and sale of castings and machined camshafts for the automobile industry in India, Asia, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success