- India

- /

- Auto Components

- /

- NSEI:MUNJALAU

Munjal Auto Industries Limited's (NSE:MUNJALAU) 31% Share Price Surge Not Quite Adding Up

Munjal Auto Industries Limited (NSE:MUNJALAU) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

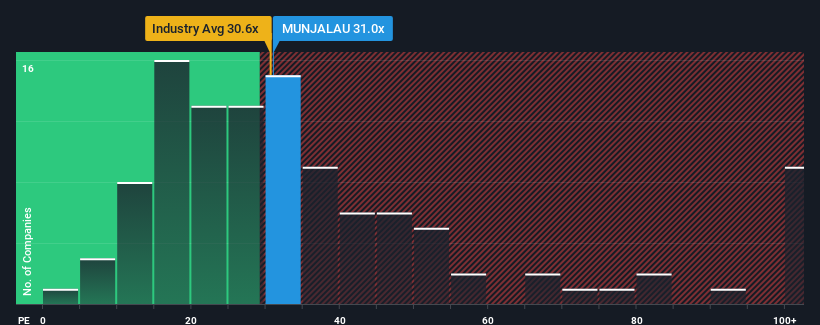

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Munjal Auto Industries' P/E ratio of 31x, since the median price-to-earnings (or "P/E") ratio in India is also close to 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Munjal Auto Industries' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Munjal Auto Industries

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Munjal Auto Industries' is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Munjal Auto Industries' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Munjal Auto Industries' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Munjal Auto Industries currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Munjal Auto Industries you should know about.

If these risks are making you reconsider your opinion on Munjal Auto Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MUNJALAU

Munjal Auto Industries

Manufactures and sells auto components for motor vehicles in India.

Low risk and slightly overvalued.

Market Insights

Community Narratives