- India

- /

- Auto Components

- /

- NSEI:LUMAXTECH

Market Might Still Lack Some Conviction On Lumax Auto Technologies Limited (NSE:LUMAXTECH) Even After 27% Share Price Boost

Lumax Auto Technologies Limited (NSE:LUMAXTECH) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 60% in the last year.

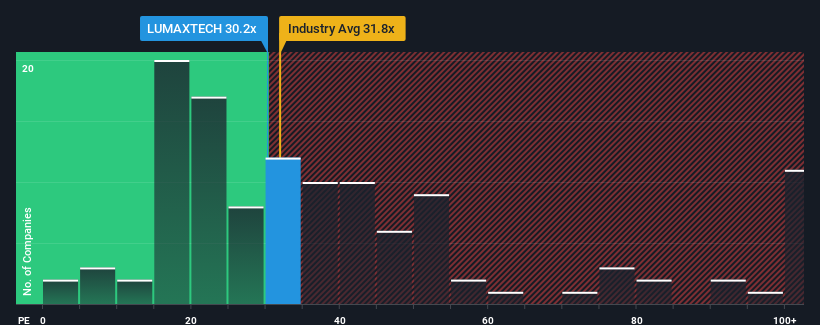

In spite of the firm bounce in price, Lumax Auto Technologies' price-to-earnings (or "P/E") ratio of 30.2x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 66x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Lumax Auto Technologies has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Lumax Auto Technologies

Is There Any Growth For Lumax Auto Technologies?

The only time you'd be truly comfortable seeing a P/E as low as Lumax Auto Technologies' is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 176% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 47% as estimated by the four analysts watching the company. With the market only predicted to deliver 25%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Lumax Auto Technologies' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Lumax Auto Technologies' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Lumax Auto Technologies' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Lumax Auto Technologies that you should be aware of.

If these risks are making you reconsider your opinion on Lumax Auto Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LUMAXTECH

Lumax Auto Technologies

Manufactures and sells automotive components in India.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives