- India

- /

- Auto Components

- /

- NSEI:HITECHGEAR

We Think Shareholders Will Probably Be Generous With The Hi-Tech Gears Limited's (NSE:HITECHGEAR) CEO Compensation

Key Insights

- Hi-Tech Gears' Annual General Meeting to take place on 26th of September

- Salary of ₹14.7m is part of CEO Pranav Kapuria's total remuneration

- Total compensation is similar to the industry average

- Hi-Tech Gears' total shareholder return over the past three years was 227% while its EPS grew by 37% over the past three years

The performance at The Hi-Tech Gears Limited (NSE:HITECHGEAR) has been quite strong recently and CEO Pranav Kapuria has played a role in it. Coming up to the next AGM on 26th of September, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Hi-Tech Gears

How Does Total Compensation For Pranav Kapuria Compare With Other Companies In The Industry?

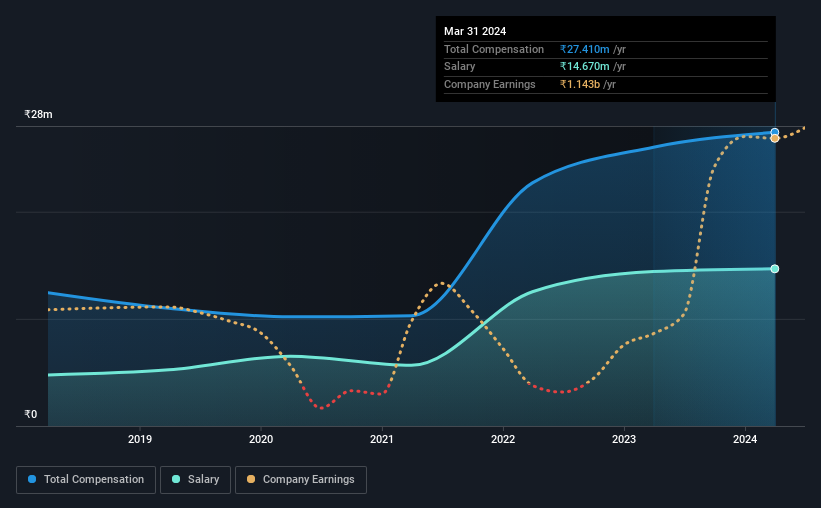

According to our data, The Hi-Tech Gears Limited has a market capitalization of ₹16b, and paid its CEO total annual compensation worth ₹27m over the year to March 2024. That's just a smallish increase of 5.4% on last year. In particular, the salary of ₹14.7m, makes up a fairly large portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Indian Auto Components industry with market capitalizations between ₹8.4b and ₹33b, we discovered that the median CEO total compensation of that group was ₹28m. So it looks like Hi-Tech Gears compensates Pranav Kapuria in line with the median for the industry. Moreover, Pranav Kapuria also holds ₹742m worth of Hi-Tech Gears stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹15m | ₹14m | 54% |

| Other | ₹13m | ₹12m | 46% |

| Total Compensation | ₹27m | ₹26m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. It's interesting to note that Hi-Tech Gears allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

The Hi-Tech Gears Limited's Growth

The Hi-Tech Gears Limited has seen its earnings per share (EPS) increase by 37% a year over the past three years. It saw its revenue drop 3.2% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has The Hi-Tech Gears Limited Been A Good Investment?

We think that the total shareholder return of 227%, over three years, would leave most The Hi-Tech Gears Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Hi-Tech Gears (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hi-Tech Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HITECHGEAR

Hi-Tech Gears

Manufactures and sells auto components for automobile manufacturers in India, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion