- India

- /

- Auto Components

- /

- NSEI:HINDCOMPOS

We Think Hindustan Composites Limited's (NSE:HINDCOMPOS) CEO Compensation Looks Fair

The performance at Hindustan Composites Limited (NSE:HINDCOMPOS) has been quite strong recently and CEO Pawan Choudhary has played a role in it. Coming up to the next AGM on 29 September 2022, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for Hindustan Composites

Comparing Hindustan Composites Limited's CEO Compensation With The Industry

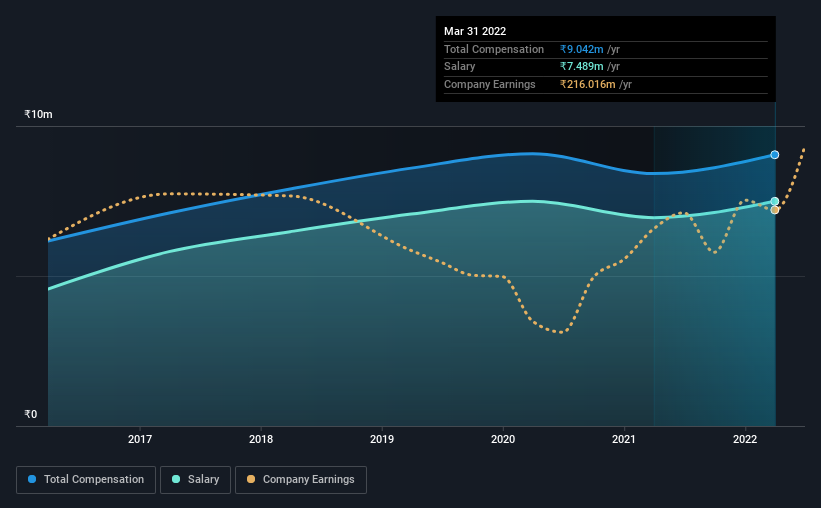

According to our data, Hindustan Composites Limited has a market capitalization of ₹5.4b, and paid its CEO total annual compensation worth ₹9.0m over the year to March 2022. That's a fairly small increase of 7.4% over the previous year. We note that the salary portion, which stands at ₹7.49m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below ₹16b, reported a median total CEO compensation of ₹11m. So it looks like Hindustan Composites compensates Pawan Choudhary in line with the median for the industry.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹7.5m | ₹6.9m | 83% |

| Other | ₹1.6m | ₹1.5m | 17% |

| Total Compensation | ₹9.0m | ₹8.4m | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. Hindustan Composites is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Hindustan Composites Limited's Growth

Over the past three years, Hindustan Composites Limited has seen its earnings per share (EPS) grow by 20% per year. It achieved revenue growth of 26% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Hindustan Composites Limited Been A Good Investment?

Most shareholders would probably be pleased with Hindustan Composites Limited for providing a total return of 99% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Hindustan Composites that investors should think about before committing capital to this stock.

Important note: Hindustan Composites is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDCOMPOS

Hindustan Composites

Develops, manufactures, and markets fibre-based friction materials in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026