G N A Axles Limited (NSE:GNA) is about to trade ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase G N A Axles' shares before the 6th of September in order to be eligible for the dividend, which will be paid on the 19th of October.

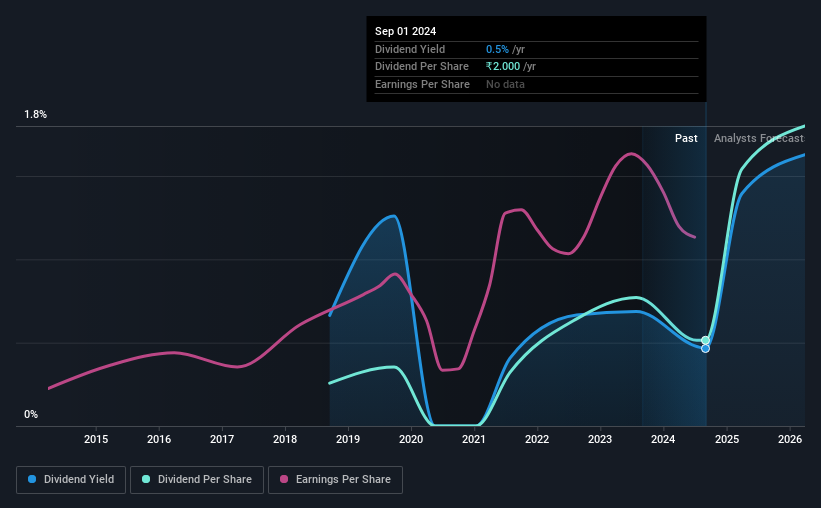

The company's next dividend payment will be ₹2.00 per share, on the back of last year when the company paid a total of ₹2.00 to shareholders. Looking at the last 12 months of distributions, G N A Axles has a trailing yield of approximately 0.5% on its current stock price of ₹430.30. If you buy this business for its dividend, you should have an idea of whether G N A Axles's dividend is reliable and sustainable. So we need to investigate whether G N A Axles can afford its dividend, and if the dividend could grow.

Check out our latest analysis for G N A Axles

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. G N A Axles paid out just 8.6% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether G N A Axles generated enough free cash flow to afford its dividend. Over the past year it paid out 132% of its free cash flow as dividends, which is uncomfortably high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

G N A Axles paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to G N A Axles's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're encouraged by the steady growth at G N A Axles, with earnings per share up 7.5% on average over the last five years. Earnings have been growing at a steady rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. G N A Axles has delivered 12% dividend growth per year on average over the past six years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has G N A Axles got what it takes to maintain its dividend payments? G N A Axles has seen its earnings per share grow steadily and paid out less than half its profit over the last year. Unfortunately, its dividend was not well covered by free cash flow. To summarise, G N A Axles looks okay on this analysis, although it doesn't appear a stand-out opportunity.

If you're not too concerned about G N A Axles's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. In terms of investment risks, we've identified 1 warning sign with G N A Axles and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GNA

G N A Axles

Manufactures and sells automotive transmission components for the four-wheeler industry in North America, South America, Europe, Asia, and Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion